What is the risk of selling a put option

In matters of personal finance, income is king. Treasurys, bank CDs, and savings accounts are all yielding next to nothing.

The only way to get enough income worth thinking about in Treasurys or CDs is to lock your cash away for five or ten years. Thankfully, there is a better way. If it goes up, you lose your total investment. It comes to your bank account right away!

INTC as an example.

But by using a margin account, which most brokers will allow you to do, you can get by with only depositing one-fifth of the capital — so, enough to buy 20 shares.

You stand to accumulate a better yield on your capital this way. When making the trade, pay close attention to the language. Make sure you are using put options and have selected to sell to open, instead of sell to close. The option symbol for this is INTCP Remember that an options contract equals shares.

That is an instant yield of 4.

Introduction To Put Writing

Call your broker today and make this trade, and see for yourself just how easy and profitable put selling can be.

Regards, Chad Shoop Editor, Pure Income. If you liked this article, check out my premium service , where I deliver trades like this straight to your inbox every week.

Chad is an investment analyst for The Sovereign Society and is also the editor of Pure Income , a newsletter that taps into the best off-the-radar opportunities for generating safe, steady monthly income. What if you sell a put option at a price that is higher than the stock price? Such as the stock is trading at 21 per share.

Let me know if that makes sense. But remember that if the stock goes to Be prepared to buy the stock to cover your position. You will be called and you will have to deliver the stock to the person that bought the 24 strike calls. This is what is known as going naked. Even more is if its cash secured on blue chip stocks. The Sovereign Investor Daily, like no other publication, has opened my eyes to what is really happening in this country.

I only wish I had known sooner! I just found the Sovereign Investor Daily website today…I must have read everything on there. Thank you so much.

I thought I was the only one. You hit the nail on the head. Thanks for your enlightenment.

I have been a subscriber to this newsletter for a long time and it is wonderful. Great investment advise and overview of the news.

Error (Forbidden)

The economic perspective is way ahead of the curve and tells things the TV talking heads never tell you! Sovereign investor is a good newsletter that lets people know what is of value in the economy sector. Great advice and timely action, not REACTION.

Options Benefits & Risks - umisifuy.web.fc2.com

The Sovereign Investor Daily is always on top of their game. The Sovereign Society is one of the few companies who actually listen to what I tell them….

Box Delray Beach, FL Toll-Free Phone: Not the ideal scenario for someone looking for additional income. But, there is another important aspect to selling put options — using margin. Action to Take When making the trade, pay close attention to the language. Regards, Chad Shoop Editor, Pure Income P. Read More Articles On This Topic: Steady Income in an Unstable Market Net Metering: Affordable Solar Panels that Actually Pay You The Three Toxins in Your Shaving Cream You Want to Avoid.

Get More Like It Delivered Straight To Your Inbox!

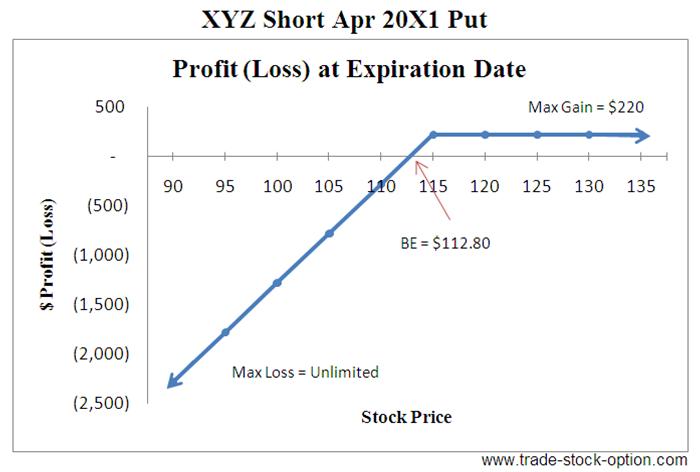

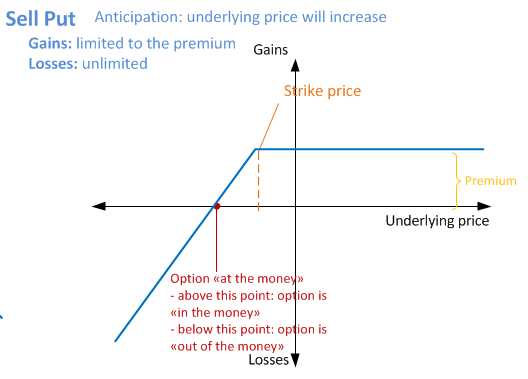

Risk of selling put options

Enter your email below to get The Sovereign Investor Daily absolutely Free! Well presented and interesting.

What our Readers are saying.. Thanks for all you do, great information. Just wanted to say thanks for your articles that pointed me in the right direction. The Sovereign Society is one of the few companies who actually listen to what I tell them… Lance S.