Currency option trading

A security that allows currency traders to realize gains without having to purchase the underlying currency pair.

By incorporating leverageforex options magnify returns and provide a set downside risk. Alternatively, currency trading options can be held alongside the underlying forex pair to lock in profits or minimize risk. In this case, limiting the upside potential is usually necessary for capping the downside as well.

Because options contracts implement leverage, traders are able to profit from much smaller moves when using an options contract than a traditional retail forex trade would allow. When combining traditional positions with a forex option, hedging strategies such as straddlesstrangles and spreads can be used to minimize the risk of loss in a currency trade.

Because of the risk of loss involved in writing options, most retail forex brokers do not allow traders to sell options contracts without high levels of capital for protection. Not all retail forex brokers provide the opportunity for option trading. Retail forex traders should research prospective brokers because for traders who intend to trade forex options online, having a broker that allows you to trade options alongside traditional positions is valuable; however, traders can also open a separate account and buy options through a different broker.

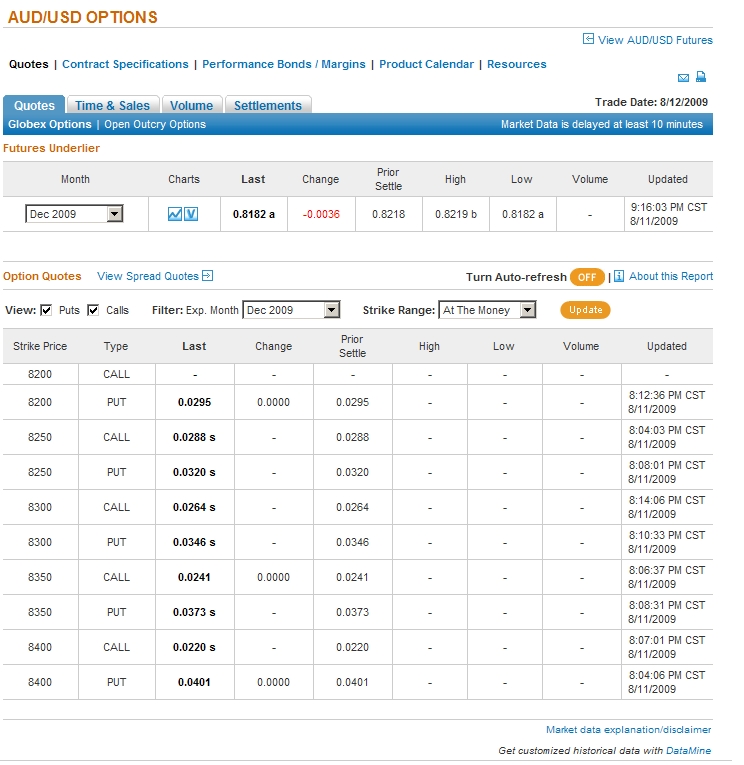

There are two types of options available to retail forex traders for currency option trading: The call option gives the buyer the right to purchase a currency pair at a given exchange rate at some time in the future. The put option gives the buyer the right to sell a currency currency option trading at a given exchange rate at some time in the future.

OANDA's BoxOption Opens a New Era in Currency Options Trading | OANDA

Both the put and call options are a right to buy or sell, currency option trading make money with binary option robot youtube an obligation. If the current exchange rate puts the options out of the moneythen the options will cara main forex demo worthless.

Single payment options trading SPOT options have a higher premium cost compared to traditional options, but they are easier to set and execute.

Foreign exchange option - Wikipedia

A currency trader buys a SPOT option by inputing a desired scenario e. If the buyer purchases this option, the SPOT will automatically pay out if the scenario occurs. Essentially, the option is automatically converted to cash.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Series 7: Options-Foreign Currency Options Flashcards | Quizlet

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Forex Option Trading Forex Hedge Forex Spot Rate Call On A Put Exotic Option Put On A Call Short Leg European Option Stock Option.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

FX Options Trading | Saxo Group

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.