Benefits of buyback of shares

There are a number of ways in which a company can return wealth to its shareholders. Although stock price appreciation and dividends are the two most common ways of doing this, there are other useful, and often overlooked, ways for companies to share their wealth with investors.

In this article, we will look at one of those overlooked methods: We'll go through the mechanics of a share buyback and what it means for investors. The Meaning of Buybacks A stock buyback, also known as a "share repurchase", is a company's buying back its shares from the marketplace. You can think of a buyback as a company investing in itself, or using its cash to buy its own shares. The idea is simple: When this happens, the relative ownership stake of each investor increases because there are fewer shares, or claims, on the earnings of the company.

Tender Offer Shareholders may be presented with a tender offer by the company to submit, or tender, a portion or all of their shares within a certain time frame.

The tender offer will stipulate both the number of shares the company is looking to repurchase and the price range they are willing to pay almost always at a premium to the market price. When investors take up the offer, they will state the number of shares they want to tender along with the price they are willing to accept.

Once the company has received all of the offers, it will find the right mix to buy the shares at the lowest cost. Open Market The second alternative a company has is to buy shares on the open market, just like an individual investor would, at the market price. It is important to note, however, that when a company announces a buyback it is usually perceived by the market as a positive thing, which often causes the share price to shoot up.

The Motives If you ask a firm's management, they'll likely tell you that a buyback is the best use of capital at a particular time. After all, the goal of a firm's management is to maximize return for shareholders and a buyback generally increases shareholder value.

The prototypical line in a buyback press release is "we don't see any better investment than in ourselves. Nevertheless, there are still sound motives that drive companies to repurchase shares. For example, management may feel the market has discounted its share price too steeply.

A stock price can be pummeled by the market for many reasons like weaker-than-expected earnings results, an accounting scandal or just a poor overall economic climate. Thus, when a company spends millions of dollars buying up its own shares, it says management believes that the market has gone too far in discounting the shares - a positive sign. Improving Financial Ratios Another reason a company might pursue a buyback is solely to improve its financial ratios - metrics upon which the market seems to be heavily focused.

This motivation is questionable. If reducing the number of shares is not done in an attempt to create more value for shareholders but rather make financial ratios look better, there is likely to be a problem with the management. However, if a company's motive for initiating a buyback program is sound, the improvement of its financial ratios in the process may just be a byproduct of a good corporate decision.

In what situations does it benefit a company to buy back outstanding shares? | Investopedia

Let's look at how this happens. First of all, share bratislava stock exchange trading hours reduce the number of shares outstanding. Once a company purchases its shares, it often cancels them or keeps them as treasury shares and reduces the number of shares outstanding, in the process.

Moreover, buybacks reduce the assets on the balance sheet remember cash is an asset. As a result, return on assets ROA actually increases because assets are reduced; return on equity ROE increases because there is less outstanding equity.

In general, the market views higher ROA and ROE as positives. Below are the components of the ROA and earnings per share EPS calculations and how they change as a result of the buyback.

This then leads to an increase in its ROA, even though earnings have not changed. Dilution Another reason that a company may move forward with a buyback is to reduce the dilution that is often caused by generous employee stock option plans ESOP. Bull markets and strong forex price action signals often create a very competitive labor market - companies have to compete to retain personnel and ESOPs comprise many compensation packages.

Stock options have the opposite effect of share repurchases, as they increase the number of shares outstanding when the options are exercised.

Stock Buyback, Repurchase ▌FinanceIn the case of dilution, it has benefits of buyback of shares opposite effect of repurchase: Continuing with the previous example, let's assume, instead, that the shares in the company had increased by cara main forex demo million.

In this case, its EPS would have fallen to 18 cents per share from 20 cents per share. After years of lucrative stock option binary options signals pro review, a company may feel the need to repurchase shares to avoid or eliminate excessive dilution. Tax Benefit In many ways, a buyback is similar to a dividend because the company is distributing money to shareholders. Traditionally, a major advantage that buybacks had over dividends was that they were taxed at the lower capital-gains tax ratewhereas dividends are taxed at ordinary income tax rates.

Stock Buybacks - The Benefits and Pitfalls

However, with the Jobs and Growth Tax Relief Reconciliation Act ofthe tax rate on dividends is hsbc share trading account uk equivalent to the rate on capital gains. The Bottom Line Are share buybacks good or bad?

As is so often the case in finance, the question may not have a definitive answer. If a stock is undervalued and a buyback truly represents the best possible investment for a company, the buyback - and its effects - can be viewed as a positive sign for shareholders. Watch out, however, if a company is merely using buybacks to prop up ratios, provide short-term relief to an ailing stock price or to get out from under excessive dilution.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Forex xtb forum This Mistake Could Cost You Guides Benefits of buyback of shares Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Share buybacks: How does a company benefit from buying back shares

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Breakdown By Cory Janssen Updated November 13, — 1: Typically, buybacks are carried out in one of two ways: Now let's look at why a company would initiate such a plan. The "True" Cost Of Stock Options Bull markets and strong economies often create a very competitive labor market - companies have to compete to retain personnel and ESOPs comprise many compensation packages.

From a financial perspective, buybacks benefit investors by improving shareholder value, increasing share prices, and creating tax beneficial opportunities.

In recent years, the value of stock buybacks has come into question. Here we break down the trend and weigh the pros and cons of share repurchasing.

Buying back shares can be a sensible way for companies to use extra cash. But in many cases, it's just a ploy to boost earnings. Find out the story behind company stock buyback programs and how some of the larger stock buybacks of have fared for shareholders. Stock buyback programs aren't always done with the interests of shareholders in mind.

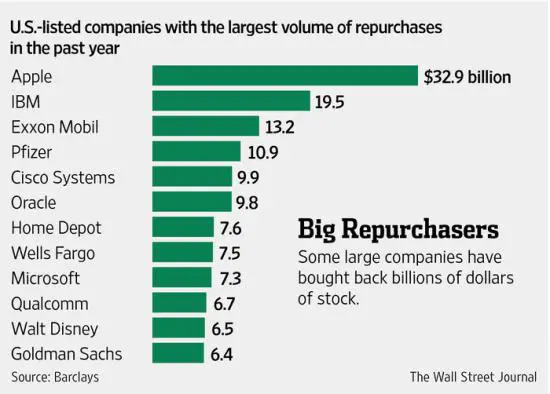

It's important to try to understand the motivation behind such moves. Learn the motivations behind share repurchase programs, including how they can mask slowing organic growth and why many companies buy their shares high and sell low. Stock buyback refers to publicly traded companies buying back their shares from shareholders. Why would they do that? Companies are repurchasing their own shares at a rate not seen in nearly a decade, prompting observers to fret that demand for equities is not as strong as the past six weeks' rally would suggest.

Understand the nature of stock buybacks and why many investors and analysts consider them to be controversial despite their Learn about stock buybacks and what they can mean about a company's financial health depending on the motivation behind their Learn about how companies use stock buybacks in order to facilitate executive compensation and why the practice is very controversial.

Learn about what types of businesses typically execute stock buybacks and what this maneuver can indicated about a business' Learn how buying back shares can negatively affect a company's credit rating if the company uses debt to finance a share An odd-lot buyback occurs when a company offers to purchase shares of its stock back from people who hold less than shares.

An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

9 Advantages of Buyback of Shares

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.