Backtesting options strategies thinkorswim

Looking for a quick way to backtest option strategies? You can use Excel to count occurrences of historical prices outside a price band you set to develop an expectation for future price movement.

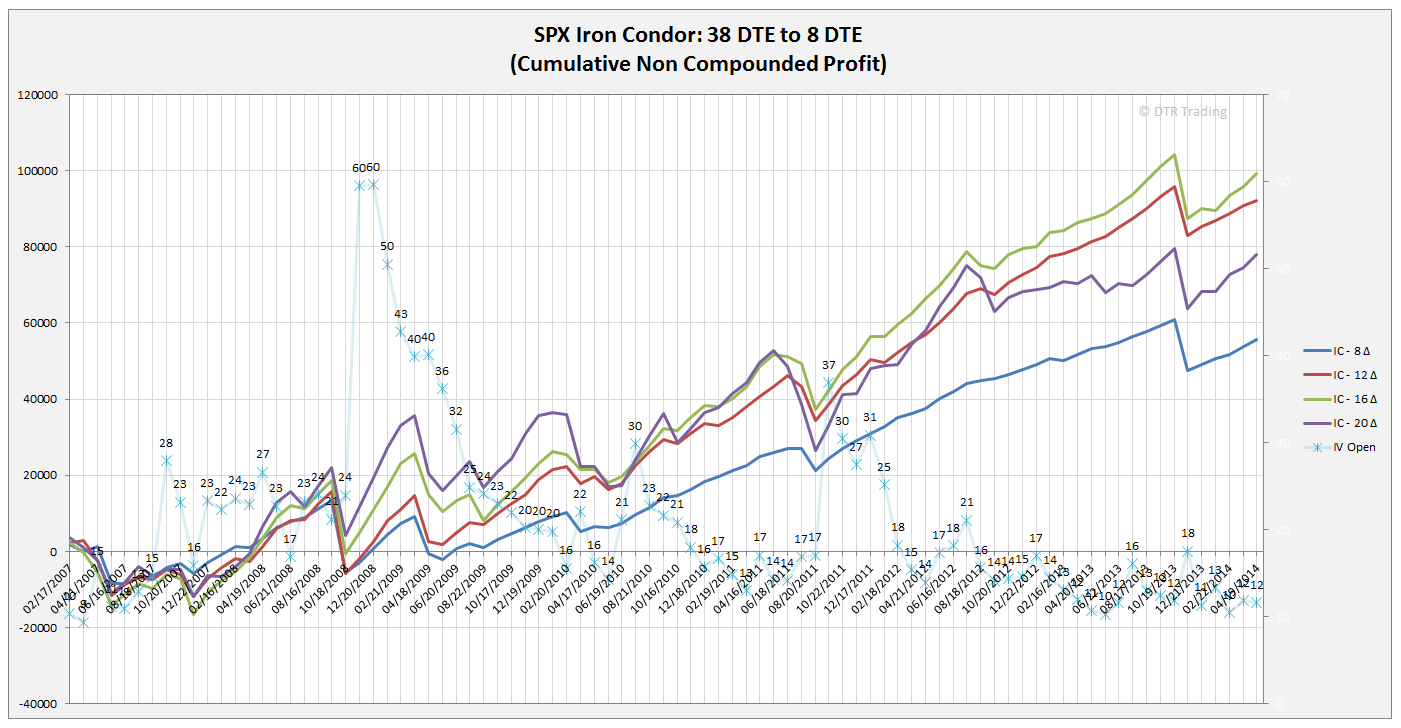

Only one aspect of the option trading experience remains, more or less, as it was years ago — option strategy backtesting. If I put on this Spx or Spy or Rut or Etf or Xyz butterfly, condor, calendar, or double diagonal, what are my chances of success based on the recent past?

That is the biggest question for every option trader.

best way to backtest option strategies? | Elite Trader

For a back-of-the-envelope type calculation, some use deltas as shorthand for the probability of going in-the-money.

Thinkorswim does this, for example.

Trading Strategy: Backtest with thinkOnDemand - Ticker Tape

Once a bull market run began here in the SPY, it exceeded the daily variance bands that is, last price was constantly equal to or greater than 7. OPTIONS Using Sample Variance Backtesting Option Strategies by John A. Sarkett Looking for a quick way to backtest option strategies?