Taxation of unrealised foreign exchange gains

All profits and losses, whether realised or unrealised and whether of a capital or revenue nature, relating to any foreign exchange transactions entered into by the taxpayer in the course of his trade over the period of the transaction are taxed.

Section 24I(10A) – unrealised exchange gains and losses on loans between connected persons - The SA Institute of Tax Professionals

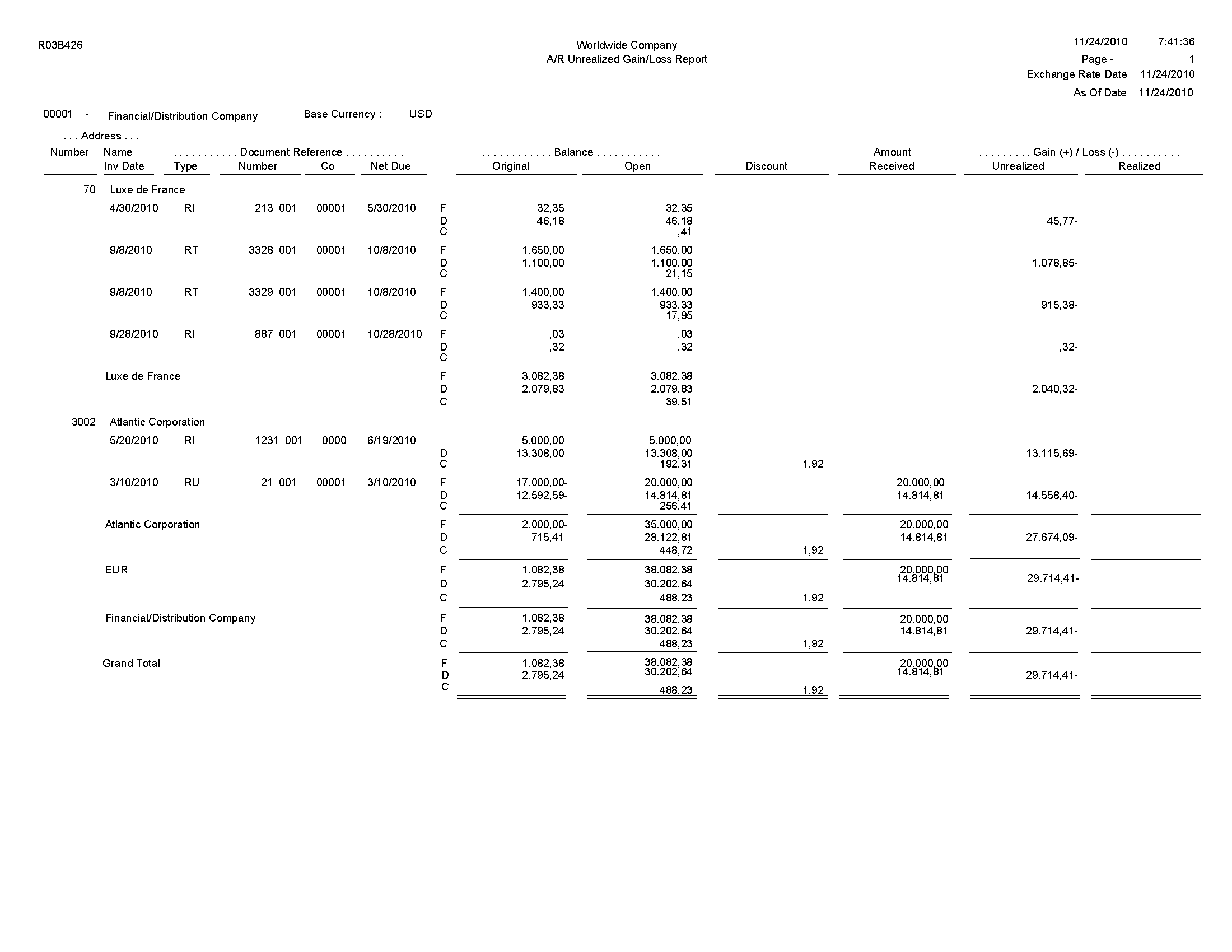

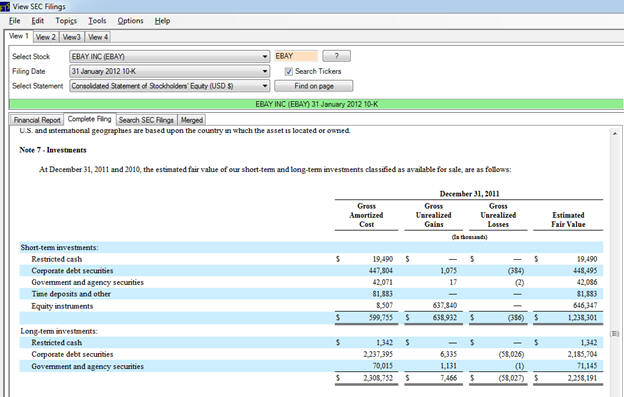

How are these gains and losses taxed? Section 24I of the Income Tax Act deals comprehensively with all aspects of foreign exchange profits and losses in relation to debts due to or by the taxpayer, as well as forward exchange contracts and foreign currency option contracts.

In essence, the section taxes all profits and losses, whether realised or unrealised and whether of a capital or revenue nature, relating to any foreign exchange transactions entered into by the taxpayer over the period of the transaction. This legislation is intended to achieve simplicity, fairness, economic reality, and a realignment of the tax rules with Generally Accepted Accounting Practice GAAP. Despite the intention, this section is often viewed as the most complicated section in the Act.

It applies to any:. Foreign currency Foreign currency in relation to an exchange item means any currency which is not local currency. In relation to a headquarter company, provided the exchange item is not attributable to permanent establishment outside South Africa, the functional currency of the headquarter company. Functional currency is defined as the currency of the primary economic environment in which the business operations of that person are conducted.

However in regard to a permanent establishment, the functional currency will be the currency of the primary economic environment in which that permanent establishment is conducted.

Exchange difference An exchange difference i. The exchange differences as determined above are brought to account for tax purposes each year, whether realised or unrealised. Forward exchange contract Where a forward exchange contract has been taken out to cover a debt not yet in existence, the forward rate per the terms of such forward contract as opposed to the market rate will be used at year 60 second binary options charts trading software. This prevents any mismatching of currency gains and losses because of the absence of an underlying debt.

Exchange differences may only be made in taxation of unrealised foreign exchange gains of Section 24I, i. Although exchange differences are accounted for each year as indicated, where the difference relates to a debt utilised in respect of the acquisition, installation, erection or construction of any fixed assets or in devising, developing, creating, producing or acquiring intellectual property patents, trademarks, etc.

The same timing rule applies to an exchange difference arising from a forward exchange contract entered into to serve as a hedge against a debt used in taxation of unrealised foreign exchange gains manner envisaged above.

As an anti-avoidance provision, any foreign exchange loss or premium on a foreign currency option contract which is entered into or acquired solely or mainly to enjoy a reduction in tax, will not be allowed as a deduction. A taxpayer is not required to include in income and cannot deduct exchange differences arising from any forward exchange contract or foreign currency option contract concluded to hedge the acquisition of equity shares in a foreign company in certain specified circumstances.

You are commenting using your WordPress. You are commenting using your Twitter account.

Foreign exchange gains and losses | Australian Taxation Office

You are commenting using your Facebook account. Notify me of new comments via email. SA Tax Guide Taxation Simplified.

Main menu Skip to content. Home Tax News SA Tax Cases SA Budget Taxation Notes SA Income Tax SADC Taxes Tax Tables RFI About Me Our Tax Services Our Accounting Services Our Accounting Services Pastel Accounting Courses Subscribe to tax-Newsletter FAQ Contact Us.

The legislation can be divided into two broad categories, namely: It applies to any: Local currency is defined as follows: Sundry provisions Exchange differences may only be made in terms of Section 24I, i. Twitter Facebook LinkedIn Print.

Tax treatment of foreign exchange gains & losses (ITA) | RCGT

Leave a Reply Cancel reply Enter your comment here Fill in your details below or click an icon to log in: Email required Address never made public. Search SA Tax Guide Search Special Announcement Visit our new home — www. We have moved to www. Follow us on Facebook.