Daily trading volume in the foreign exchange market was about ________ per ________ in 2007

Search the history of over billion web pages on the Internet. Featured texts All Texts latest This Just In Smithsonian Libraries FEDLINK US Genealogy Lincoln Collection Additional Collections.

Top American Libraries Canadian Libraries Universal Library Community Texts Project Gutenberg Biodiversity Heritage Library Children's Library. Featured movies All Video latest This Just In Prelinger Archives Democracy Now!

Occupy Wall Street TV NSA Clip Library. Featured audio All Audio latest This Just In Grateful Dead Netlabels Old Time Radio 78 RPMs and Cylinder Recordings. Featured software All Software latest This Just In Old School Emulation MS-DOS Games Historical Software Classic PC Games Software Library.

Top Community Software MS-DOS CD-ROM Software Software Sites Tucows Software Library APK Shareware CD-ROMs. Vintage Software ZX Spectrum Vectrex ZX Spectrum Library: Games Atari Magnavox Odyssey 2 Bally Astrocade. Featured image All Image latest This Just In Flickr Commons Occupy Wall Street Flickr Cover Art USGS Maps. Top NASA Images Solar System Collection Ames Research Center.

Toggle navigation ABOUT CONTACT BLOG PROJECTS HELP DONATE TERMS JOBS VOLUNTEER PEOPLE. A The market provides the physical and institutional structure through which the money of one country is exchanged for another. B The rate of exchange is determined in the market.

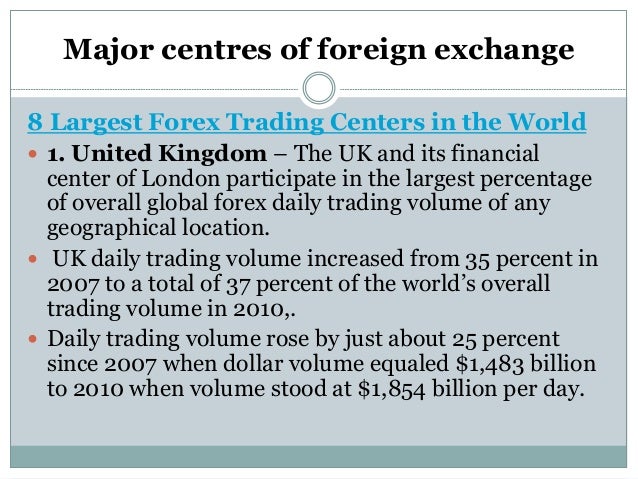

C Foreign exchange transactions are physically completed in the foreign exchange market. D All of the above are true. Introduction to the Foreign Exchange Market Skill: Recognition 3 While trading in foreign exchange takes place worldwide, the major currency trading centers are located in A London, New York, and Tokyo.

B New York, Zurich, and Bahrain. C Paris, Frankfurt, and London. D Los Angeles, New York, and London. Recognition 4 Because the market for foreign exchange is worldwide, the volume of foreign exchange currency transactions is level throughout the hour day. Recognition 5 Which of the following is NOT a motivation identified by the authors as a function of the foreign exchange market?

A The transfer of purchasing power between countries. B Obtaining or providing credit for international trade transactions. C Minimizing the risks of exchange rate changes. D All of the above were identified as functions of the foreign exchange market.

Foreign Exchange Market Functions Skill: Recognition 1 6 The authors identify two tiers of foreign exchange markets: A bank and nonbank foreign exchange. B commercial and investment transactions. C interbank and client markets. D client and retail market.

Archives - umisifuy.web.fc2.com

Foreign Exchange Market Tiers Skill: Recognition 7 The foreign exchange market is NOT efficient because A market participants do not compete with one another due to the fact that exchange takes place around the world and not in a single centralized location. B dealers have ask prices that are higher than bid prices.

C central governments dominate the foreign exchange market and everybody knows that by definition, central governments are inefficient.

Trading the Currency MarketsD none of the reasons listed are accurate because the foreign exchange market is efficient. Foreign Exchange Market Efficiency Skill: Conceptual 8 Dealers in foreign exchange departments at large international banks act as market makers and maintain inventories of the securities in which they specialize.

Foreign Exchange Market Dealers and Brokers Skill: Recognition 9 Currency trading lacks profitability for large commercial and investment banks but is maintained as a service for corporate and institutional customers. Foreign Exchange Market Profitability Skill: Recognition 10 It is characteristic of foreign exchange dealers to A bring buyers and sellers of currencies together but never to buy and hold an inventory of currency for resale.

B act as market makers, willing to buy and sell the currencies in which they specialize. C trade only with clients in the retail market and never operate in the wholesale market for foreign exchange. D All of the above are characteristics of foreign exchange dealers. Foreign Exchange Market Dealers Skill: Recognition 11 Which of the following may be participants in the foreign exchange markets? A bank and nonbank foreign exchange dealers B central banks and treasuries C speculators and arbitragers D All of the above.

Foreign Exchange FX Market Participants Skill: Recognition 2 12 seek to profit from trading in the market itself rather than having the foreign exchange transaction being incidental to the execution of a commercial or investment transaction.

A Speculators and arbitragers B Foreign exchange brokers C Central banks D Treasuries Answer: Recognition 13 In the foreign exchange market, seek all of their profit from exchange rate changes while seek to profit from simultaneous exchange rate differences in different markets. A wholesalers; retailers B central banks; treasuries C speculators; arbitragers D dealers; brokers Answer: Recognition 14 Foreign exchange earn a profit by a bid-ask spread on currencies they purchase and sell.

Foreign exchange , on the other hand, earn a profit by bringing together buyers and sellers of foreign currencies and earning a commission on each sale and purchase.

A central banks; treasuries B dealers; brokers C brokers; dealers D speculators; arbitragers Answer: Recognition 15 The primary motive of foreign exchange activities by most central banks is profit.

Recognition 16 Dealers sometimes use brokers in the foreign exchange market because the dealers desire A speed. C to remain anonymous. D all of the above. Recognition 3 17 Daily trading volume in the foreign exchange market was about per in FX Trading Volume Skill: Recognition 18 Daily trading volume of foreign exchange had actually decreased in from the levels reported in Recognition 19 are NOT one of the three categories reported for foreign exchange. A Spot transactions B Swap transactions C Strip transactions D Futures transactions Answer: Recognition 20 Foreign exchange swaps were larger in than in The Bank for International Settlements attributes this to A the introduction of the euro.

B growing electronic brokering in the spot interbank market. C consolidation in general. Recognition 21 The greatest amount of foreign exchange trading takes place in the following three cities: A New York, London, and Tokyo. B New York, Singapore, and Zurich. C London, Frankfurt, and Paris. D London, Tokyo, and Zurich. Foreign Exchange Market Locations Skill: K pound, Chinese yuan, euro, and Japanese yen. Foreign Exchange Market Currencies Skill: Recognition 23 A transaction in the foreign exchange market requires an almost immediate delivery of foreign exchange.

A spot B forward C futures D none of the above Answer: Foreign Exchange Market Transactions Skill: Recognition 24 A transaction in the foreign exchange market requires delivery of foreign exchange at some future date. A spot B forward C swap D currency Answer: Recognition 25 A spot transaction in the interbank market for foreign exchange would typically involve a two-day delay in the actual delivery of the currencies, while such a transaction between a bank and its commercial customer would not necessarily involve a two -day wait.

Foreign Exchange Market Spot Transactions Skill: Recognition 26 A forward contract to deliver British pounds for U. A buying dollars forward; buying pounds forward B selling pounds forward; selling dollars forward C selling pounds forward; buying dollars forward D selling dollars forward; buying pounds forward Answer: Foreign Exchange Market Forward Transactions Skill: Recognition 5 27 A common type of swap transaction in the foreign exchange market is the where the dealer buys the currency in the spot market and sells the same amount back to the same bank in the forward market.

A "forward against spot" B "forspot" C "repurchase agreement" D "spot against forward" Answer: Foreign Exchange Market Swaps Skill: Recognition 28 Swap and forward transactions account for an insignificant portion of the foreign exchange market.

Recognition 29 The is a derivative forward contract that was created in the s.

It has the same characteristics and documentation requirements as traditional forward contracts except that they are only settled in U. A nondeliverable forward B dollar only forward C virtual forward D internet forward Answer: Foreign Exchange Market Derivatives Skill: Recognition 30 Which of the following is NOT true regarding nondeliverable forward NDF contracts? A NDFs are used primarily for emerging market currencies. B Pricing of NDFs reflects basic interest rate differentials plus an additional premium charged for dollar settlement.

C NDFs can only be traded by central banks. Foreign Exchange Market NDFs Skill: Conceptual 31 A foreign exchange is the price of one currency expressed in terms of another currency.

A foreign exchange is a willingness to buy or sell at the announced rate. A quote; rate B quote; quote C rate; quote D rate; rate Answer: Foreign Exchange Market Rates and Quotes Skill: Recognition 6 32 Most foreign exchange transactions are through the U.

If the transaction is expressed as the foreign currency per dollar this known as whereas are expressed as dollars per foreign unit. A European terms; indirect B American terms; direct C American terms; European terms D European terms; American terms Answer: Foreign Exchange Market Terms Skill: Recognition 33 The following is an example of an American term foreign exchange quote: D None of the above.

Recognition 34 The European and American terms for foreign currency exchange are square roots of one another. Recognition 35 With several exceptions, most interbank quotes are stated in European terms meaning foreign currency unit per U.

Recognition 36 American and British meanings differ for the word billion. A Kiwi B Loony C Uncle Sam D Yard Answer: Recognition 37 Major exceptions to using European terms in foreign exchange include A trading yen and euros.

B pounds and euros. C Mexican Pesos and euros. Foreign Exchange Terms Skill: Recognition 7 38 From the viewpoint of a British investor, which of the following would be a direct quote in the foreign exchange market? A direct; direct B direct; indirect C indirect; indirect D indirect; direct Answer: Direct and Indirect Quotes Skill: Recognition 40 If the direct quote for a U.

Analytical 41 make money on currency exchanges by the difference between the price, or the price they offer to pay, and the price, or the price at which they offer to sell the currency. A Dealers; ask; bid B Dealers; bid; ask C Brokers; ask; bid D Brokers; bid; ask Answer: Recognition 8 TABLE 6.

The current spot rate of dollars per pound as quoted in a newspaper is or. Spot Rate Calculation Skill: Analytical 43 Refer to Table 6. The one-month forward bid price for dollars as denominated in Japanese yen is.

Analytical 44 Refer to Table 6. The ask price for the two-year swap for a British pound is. Analytical 9 45 Refer to Table 6. According to the information provided in the table, the 6-month yen is selling at a forward of approximately per annum. Use the mid rates to make your calculations. Forward Premium Calculation Skill: Analytical 46 Refer to Table 6.

Cross rates A are often reported in the form of a matrix in the financial newspapers. B can be used to check on opportunities for intermarket arbitrage. C for the spot market in the table are 5 D are all of the above. Recognition 47 Given the following exchange rates, which of the multiple -choice choices represents a potentially profitable intermarket arbitrage opportunity? Analytical 48 For arbitrage opportunities to be practical, A participants must have instant access to quotes.

B participants must have instant access to executions. C bank traders must be able to execute the arbitrage trades without an initial sum of money relying on their bank's credit standing.

D all of the above must be true. Conceptual 10 49 The U. Thus, the dollar has by. Analytical 50 When the cross rate for currencies offered by two banks differs from the exchange rate offered by a third bank, a triangular arbitrage opportunity exists. Recognition 51 Most transactions in the interbank foreign exchange trading are primarily conducted via telecommunication techniques and little is conducted face-to-face. Interbank Foreign Exchange Skill: Daily Foreign Exchange Skill: Recognition 53 Given the following pair wise exchange rates, estimate the cross-rate of pounds per euro.

Analytical 54 Given the following quotations where the dollar is the home currency , what is the annualized forward premium discount on the U.

Recognition 56 The Continuous Linked Settlement system CLS links with the Real-Time Gross Settlement RTGS systems and is expected to eventually result in same-day settlement rather than the current two-day settlement required for foreign exchange spot market transactions. Which of the following do experts think was a major driving force behind the increased daily volume? A increased activity by specialized investment groups such as hedge funds B institutional investors holding more internationally diversified portfolios thus requiring more currency transactions C increased use of technical computer-based trading D all of the above Answer: Recognition 58 New York City has the greatest volume of foreign exchange activity in the world.

Recognition Essay Questions 1 What are some of the reasons central banks and treasuries enter the foreign exchange markets, and in what important ways are they different from other foreign exchange participants?

Unlike other market participants, they are not profit oriented. Instead, they may willingly take a loss if they think it is in their best national interest.

Spot transactions are exchanging one currency for another right now. Spot transactions are typically entered into because the parties need to exchange foreign currencies that they have received into their domestic currency, or because they have an obligation that requires them to obtain foreign currency. Forward foreign exchange transactions are agreements entered into today to exchange currencies at a particular price at some point in the future.

1) The ________ Is The Mechanism By Which Particip | umisifuy.web.fc2.com

Forwards may be speculative or a hedge against unexpected changes in the price of the other currency. Swaps are the simultaneous purchase and sale of a given amount of a foreign exchange for two different dates. Both transactions are conducted with the same counterparty. A swap may be considered a technique for borrowing another currency on a fully collateralized basis.