Radford market stock units

This material is provided for informational purposes only and is not advice or a recommendation for the purchase or sale of any security. This information reflects subjective judgments and assumptions, and unexpected events may occur.

Therefore, there can be no assurance that developments will transpire as forecasted.

Not Found

This material reflects the opinion of SHGA on the date made and is subject to change at any time without notice. SHGA has no obligation to update this material. We do not suggest that any strategy described herein is applicable to every client of or portfolio managed by SHGA. In preparing this material, SHGA has not taken into account the investment objectives, financial situation or particular needs of any particular person.

Before making an investment decision, you should consider, with or without the assistance of a professional advisor, whether the information provided in this material is appropriate in light of your particular investment needs, objectives and financial circumstances.

Transactions in securities give rise to substantial risk and are not suitable for all investors. No part of this material may be i copied, photocopied, or duplicated in any form, by any means, or ii redistributed without the prior written consent of SHGA.

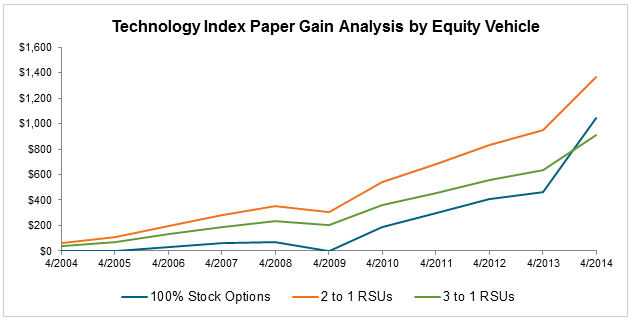

Subscribe now to receive email updates from Sand Hill directly to your inbox! The New Currency of the Valley. The New Currency of the Valley Posted by: The Valley has experienced a dramatic shift over the years from using the competitive value proposition of stock options to attract and retain top talent, to offering restricted stock units as an attractive enticement.

This trend started to develop as the incentive models of stock options showed diminishing effectiveness; employees began to realize that a start-up company would have to go public and rise significantly in value for an option strategy to pay in spades.

In reality, companies can stay private for a very long time and market volatility can make the difference between hitting the lottery and using your company option agreement as scratch paper. In extreme market volatility, options - at least temporarily - can be worthless if the company's stock price falls below the exercise price of the options.

The stock market downturn during this period essentially wiped out any in-the-money value in option grants for employees. Prior to that, the stock market downturn of — revealed another weak point of options.

Radford EMEA | Page 2

As a result, over the last 15 years restricted stock units have become the answer to valued incentive plans with some industries in the Valley gaining more traction than others. A very specific Valley event also helped push the change. In , Facebook realized that its number of stock option holders would soon eclipse the shareholder limit imposed by the SEC.

The same issue forced Google to go public in And so the restricted stock unit revolution was born. Start-up companies often use the restricted stock method because unlike outright compensation, it does not involve the need for immediate access to cash; in effect, RSUs represent fully valued compensation upon vesting.

That being said, they are more often found at later stage companies. For these companies, stock options would be worthless to employees until the company had actually attained and exceeded its newly inflated strike price.

Radford housing market data and appreciation trends - NeighborhoodScout

A grant of restricted stock units is always worth something, unless the stock price falls to zero. This, in turn, has the added benefit of aligning company employees and officers with their shareholders. For employees and officers with restricted stock units who have never played in this sandbox before, there are some very important wealth and tax considerations at stake.

We understand that you most likely love the company and every way they are changing the world, but markets rule and once vested, an accumulation of restricted stock units with frequent vesting have the potential to change your wealth trajectory.

The tax consequences of equity-based employee compensation are not always straightforward and are sometimes poorly understood. Employees of pre-IPO companies may face a very real problem of coming up with the resources to pay the required tax withholding that is due immediately upon RSU vesting. At this point, it would be appropriate to engage a secondary market liquidity provider. Another critical component of tax strategy is the identification of the date the holding period begins for long term versus short term capital gains treatment.

As of this writing, the date of vesting is when the holding period begins for gain treatment. However, companies may impose lengthier vesting periods such as in the case where the vesting occurs at either 1 the date determined in the stock agreement or 2 six months after an IPO, whichever is later. The holding period clock starts ticking in this case at the later date. This distinction is critical.

If you sell the stock before one year and a day after the determined vesting date, you are subjecting yourself to significantly higher taxes.

Restricted Stock Units: The New Currency of the Valley | Sand Hill Global Advisors

Both state and federal short term capital gains are taxed as ordinary income. The federal tax can be as high as It can be well worth your time to explore how to apply tax strategies to your own situation, and you should seek the help of your tax accountant and wealth advisor to help guide you in executing them properly.

Browse by Category Concentrated Wealth. Search Search blog entries. Subscribe Subscribe now to receive email updates from Sand Hill directly to your inbox!

Recent Postings An Ode to the Silicon Valley Entrepreneur. More Than Meets the Eye.

Shaken, Not Stirred…to Action. Other Posts by this Author Intellectual Property: Rolling Hills, Sweeping Plains and Dynasty Trusts. Leaving a Start-Up Company: What to Do With Your Stock Options? Empty Nesters Need to Protect Their Nest Eggs. Turn Your Wish Into a Goal: Life Transitions and Your Home. Is Your Property Sitting on a Shelf of Unclaimed Property? What Every Entrepreneur Needs to Know About Qualified Small Business Stock.

Unicorns, Thoroughbreds and Work Horses. The PATH Leads to Permanent Tax Benefits. Congress Overhauls Social Security Spousal Benefits. When Dementia is Present: Preparing and Protecting Family Wealth. A Big Year for Vesting Stock and Option Exercise? Explore Significant Tax Savings. Protecting Assets Owned by a Trust: Is Your Trust Named as an Insured?

No Longer Just for High Flyers. Taking Time to Explore Health Care Options: There's Value in Not "Going Big". Managing the Challenges of the Sandwich Generation.

Get Me to Retirement on Time: Avoid a Commonly Overlooked Estate Tax Blunder: Life Insurance Policy Ownership. Whether Pirates, Adventurers or Investors: The Tortoise and the Hare: To Give or Not to Give is Only Part of the Question.

Maximizing Your Social Security Claim: Do You Know All Your Options? Sound the Alarm… Stay the Course.