Small cap stocks 2016 india

Here are their views on the four funds. DSP BLACKROCK SMALL AND MIDCAP. He has reasonable portfolio management experience under his belt, too. He is backed by a high-calibre team, and this adds to our conviction. Sambre, on the other hand, plies his signature style here of buying into growth-oriented quality stocks and staying invested for the long haul.

Expectedly, while the fund is likely to gain more than a typical peer in up markets, it also runs the risk of faring worse in down markets. Also, over shorter time frames, it can witness bouts of intense volatility and significant underperformance.

Best Small Cap stocks in India that doubled in 1 year in | umisifuy.web.fc2.com

Sambre is a capable manager and his experience in running similar strategies is noteworthy. He appears at home with his investing style and has been fairly disciplined in his approach. Under him, the fund has the wherewithal to outperform its benchmark index and category peers over the long term. Krishnakumar is a competent fund manager with experience in small- and mid-cap research. We believe that Krishnakumar is a proficient manager in the small- and mid-cap space.

His invests in fundamentally sound stocks with positive growth prospects, good pricing power, and stable cash flows. Krishnakumar is valuation-conscious while investing in stocks but is willing to stay invested in companies with higher valuations if longer-term growth prospects appear favourable. The investment style is essentially bottom-up with a buy-and-hold philosophy on high-conviction names.

He typically seeks to invest in quality companies with differentiated businesses. An eight-member analyst team and a macroeconomist support the equity investment team.

E a small- and mid-cap-oriented fund since The strategy has its fair share of risks. The fund has a larger exposure to small- and mid-cap stocks than its category peers. This can result in an underperformance of the fund in a rally led by large-cap stocks.

In addition, the long-term orientation can mean the fund can diverge from the competition and index over shorter periods. However, the investment process can deliver pleasing results for risk-tolerant investors who can ride out short-term volatility. The challenges in managing a mid-cap fund are abundant. While unpredictability in the equity markets is accentuated in this segment, factors such as constrained liquidity, limited coverage, and poor disclosures make mid-cap investing a tricky proposition.

The need for a skilled manager and a solid investment process cannot be overstated. ICICI Prudential Midcap Fund makes the grade on both counts. Mrinal Singh is a competent portfolio manager who has been in the job since May Intensive research forms the core of his investment approach. He fluidly combines top-down and bottom-up approaches to identify companies in which to invest. Though the strategy can be termed broadly as growth-at-a-reasonable-price, Singh invests a small portion of the portfolio in value stocks as well.

Expectedly, Singh has executed the strategy with what does market cap mean on a stock quote reasonably good degree of success. The strategy has some inherent risks. Given the fund dwells in mid-cap territory, liquidity risk during testing times is inherent to the strategy. The fund has been going through trying times for some time now.

The fund is a good investment option for risk-taking investors. Hence, research experience and good execution are of paramount importance for portfolio managers in this area. Vinit Sambre fills the bill on these counts.

He is a competent analyst with reasonable portfolio management experience under his belt. He has managed this fund since June That he is backed by a high-calibre team also adds to our conviction. Sambre plies a bottom-up, buy-and-hold approach to picking stocks, scouting for growth-oriented companies that have sustainable competitive advantages over their peers and are leaders in their industries.

Although he is valuation-conscious, he believes that the companies in which he invests should command a premium given their leadership positions in their respective industries. We believe this focus on longer-term strength is a positive and helps reduce the issue-specific risks associated with a small-cap fund.

Sambre also invests a portion of the portfolio in value stocks. We believe that this approach can help reduce price risk in the portfolio, given the inherent growth bias here. Cash calls are not a part of the strategy--this is a positive as it eliminates timing risk.

For instance, Sambre may find it difficult to exit stocks when liquidity dries up--a common event in the small- and micro-cap space. A growing asset size can pose challenges in the form of market-impact cost and opportunity cost.

Top 10 Stocks to buy in Small-cap for January Indian Share Market

But on a positive note, the fund house has restricted the subscription amount to Rs 0. Nonetheless, Sambre so far has displayed an ability to contain downside risks in the portfolio. Membership Login My Profile Register.

Mutual Funds Funds Home Analyst Ratings Factsheets Fund News Screen Funds Compare Funds Instant X-Ray Rank ETFs. Equities Equities Home Stocks Quickrank Quantitative Ratings Real Time. Insurance Insurance Home Star Ratings Rank Insurance Funds.

Membership Home Portfolio Mutual Funds Equities Small cap stocks 2016 india Personal Finance Tools Archives Forex nzd vs usd Adviser.

Blue Chip Companies in India - umisifuy.web.fc2.com

Vinit Sambre Investment Style: Mid Growth Investment Process: Sambre selects companies with sustainable competitive advantages and dominant market shares. He combines growth-styled quality stocks with value plays when constructing the portfolio.

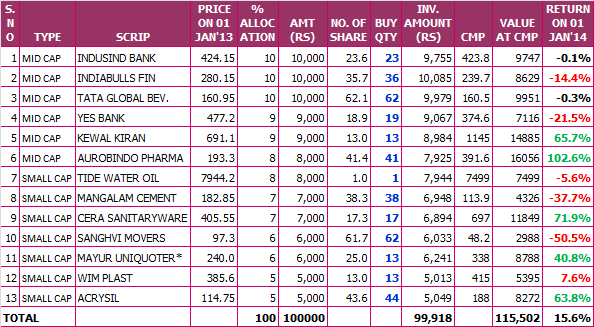

Multibaggers – Top Large Cap, Mid Cap & Small Cap Stock Recommendations (for Medium to Long term) | Wealthcom

Though its 3- 5- and year performance is in line with the category average or marginally higherthe outperformance is seen in the recent past. In fact, in it underperformed the category average. However, this year the YTD is a significant lead over the category average. SUNDARAM SELECT MID CAP Krishnakumar is a competent fund manager with experience in small- and mid-cap research. Mid Blend Investment Process: The portfolio is built based on high-conviction ideas and can tend to be sector-heavy.

A well-defined process is followed, aimed at constructing a growth-oriented long-term portfolio of stocks. A decade agothis fund topped the performance chart. Init underperformed the average.

Despite these bumps, over the long term, it has been a good performer. Mrinal Singh Investment Style: Mrinal Singh buys reasonably priced growth stocks and stays invested for the long haul.

He combines absolute and relative valuation to scout for reasonably priced growth stocks. Last year the fund underperformed the average. Its YTD has followed suit. DSP BLACKROCK MICRO CAP The fund is a good investment option for risk-taking investors. Small Growth Investment Process: The fund got noticed in and In the past 2 years it has been on a roll and delivered admirably. Click here to read full article.

Please login or register to post a comment. Ramesh Chandramouli Feb 23 Aravind Sankeerth Dec 27 I guess a newer fund called Indiabulls Value Discovery also fits the bill and the portfolio is rock hard.

Its just a matter of time it proves itself in this list. I also admire the Union Small and Midcap Fund, has a very focussed yet well set out list of stocks with low churn. Recent in Library Active gives way to passive; Passive gets more active Jun 21 Why buy low and sell high is misleading Jun 21 10 tips to be a successful equity investor Jun 20 BSL Emerging Leaders Fund Series 3: Extension of Maturity Jun 19 BSL Short Term Opportunities Fund: Recent from this Author Why buy low and sell high is misleading Jun 21 BSL Emerging Leaders Fund Series 3: Sitemap Contact Feedback Glossary Methodology Events IMO Investing Mastermind Licensing Opportunities Affiliate Careers CSR Policy Terms of Use International Sites Australia Austria Belgium Canada China Czech Republic Denmark Estonia Finland France Germany Hong Kong Hungary Iceland Ireland Italy Japan Korea Latvia Lithuania Malaysia Netherlands New Zealand Norway Poland Portugal Singapore South Africa Spain Sweden Switzerland Taiwan Thailand United Kingdom United States.

Please read our Terms of Use above. Morningstar India Private Limited; Regd. Morningstar India Help Desk e-mail: Active gives way to passive; Passive gets more active. Why buy low and sell high is misleading. BSL Emerging Leaders Fund Series 3: BSL Short Term Opportunities Fund: Recent from this Author. Axis Long Term Equity gets a Silver rating.