Average return on the stock market historically

RetireMentors features retirement advice from financial professionals, not staff journalists.

Paul Merriman is committed to educating people of all ages to get the most from their retirement investments. Founder of Merriman Wealth Management, a Seattle-based investment advisory firm, he is the author of numerous books on investing: How to Select the Best and Get the Most from Your Financial Advisor " and " Investment Decisions Guaranteed to Change Your Financial Future.

He is president of The Merriman Financial Education Foundation and all profits from the sale of his books are used to advance financial literacy. His recommendations for portfolios of Vanguard funds, Fidelity funds and ETFs, podcasts, articles and books are available at paulmerriman. Follow Paul on Twitter SavvyInvestorPM. Keep their expenses low? Hire a superstar manager? Asset class selection is the fancy name for this. Actually, setting aside some money to invest in the first place is the absolute most essential step.

But if you don't do that, then you're not even an investor. In the stock market, you can invest in popular growth stocks or unloved value stocks.

Average Stock Market Return: Where Does 7% Come From? - The Simple Dollar

You can invest in big companies large-cap or small companies small-cap. You can invest in U.

What is the average annual return for the S&P ? | Investopedia

This assumes that you invest money and leave it invested. If you move in and out of your investments, then your results are totally unpredictable. The table below shows eight decades of returns for the four most important U. In fact, over the long haul each of the other three asset classes outperforms this index by a long shot, as you will see from the right-hand column in the table. I could have made a table with single-year figures, but for most readers that would be far too much data.

One reason I chose 10 years is a famous maxim from Warren Buffett: Don't buy something unless you would be willing to hold on to it if the market were shut down for 10 years.

All four of these asset classes pass that test for me. But as you can see, from through , some of them were substantially more rewarding than others. Large Cap Value, U. Small Cap and U. Whenever I study a table of investment returns, I look for important lessons I can learn so that I'm not surprised by what the market does.

Because of the third lesson I outlined, it's impossible to know which asset class will do best next week, next month, next year or even next decade. But there's magic in combining all four of these in one portfolio.

Over 84 years from through , this Group of Four boosted the annual return from 9. If you think that's not a big deal, here's the math: By using this site you agree to the Terms of Service , Privacy Policy , and Cookie Policy. Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time. Real-time last sale data for U.

Intraday data delayed at least 15 minutes or per exchange requirements. Government will work to secure best Brexit deal for U. Updated Pound hits 2-month low as doubts over support for U. This is the exact right way to call in sick to work. Chicago Fed President Discusses Timing of Rate Increases. Opinion Service industries could use a disrupter like Amazon.

A Closer Look at Chris Wray, Trump's Pick to Lead FBI. How to protect your family members — or yourself — from elder abuse. Money CAN buy happiness, if you spend it right. Forget ping pong, this is the hot new work perk. Updated Uber CEO Travis Kalanick steps down after shareholder revolt.

Home News Viewer Video SectorWatch Podcasts First Take Games Portfolio My MarketWatch. Retirement Retire Here, Not There Encore Taxes How-to Guides Social Security Estate Planning Events Columns Robert Powell's Retirement Portfolio Andrea Coombes's Working Retirement Tools Retirement Planner How long will my money last?

Which has performed better historically, the stock market or real estate? | Investopedia

Economy Federal Reserve Capitol Report Economic Report Columns Darrell Delamaide Rex Nutting Tools Economic Calendar. My MarketWatch Watchlist Alerts Games Log In. Until New York Markets Open Market Snapshot Analyst Ratings. Retire Mentors Powered by RetireMentors features retirement advice from financial professionals, not staff journalists.

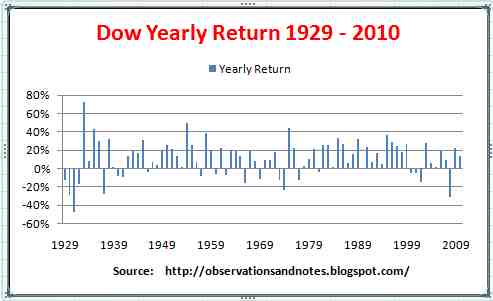

What do you think is the most important thing that investors do? Here are eight things that pop out at me from this table: It is obvious that, when measured in year increments, the market was up most of the time.

The table shows 32 year returns; 28 of them were positive, and only four were negative and three of those four occurred way back in the s. The market can have many successful decades in a row. Most investors remember that the s produced very high returns for equities, but this table shows even better returns in the s.

Leading and lagging asset classes sometimes change places. This makes it hard to pick just one and be confident it will always be on top. In the s, small-cap and small-cap value stocks clearly led the way. They did the same from through However, the s were led by large-cap value and small-cap value. In the s, s and the s, every asset class in this table produced double-digit returns — and the s came mighty close.

The most consistent high-performance winner was small-cap value stocks.

Except for the s, this asset class produced decade-long gains that were always over In only one decade, the s, did this group fail to walk away with a profit. And if you adjust it for inflation, that group's returns were actually positive: But in that decade, a portfolio that was divided equally among these four asset classes wound up being a moneymaker, with an average gain of 6. The adage that investors get paid to take risks seems to be working just fine.

Small-cap growth stocks are riskier than large-cap value stocks, and they paid more. Small-cap value stocks are the riskiest among these asset classes, and they paid the highest long-term return.

Richard Buck contributed to this article. More Coverage Avoid these chemicals found in everything from shampoo to kitchen counters: MarketWatch Site Index Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile. Dow Jones Network WSJ.