Calculate daily pivots forex

Pivot Points use the prior period's high, low and close to estimate future support and resistance levels. In this regard, Pivot Points are predictive or leading indicators. There are at least five different versions of Pivot Points. This article will focus on Standard Pivot Points, Demark Pivot Points, and Fibonacci Pivot Points. Pivot Points were originally used by floor traders to set key levels.

Floor traders are the original day traders. They deal in a very fast moving environment with a short-term focus. At the beginning of the trading day, floor traders would look at the previous day's high, low and close to calculate a Pivot Point for the current trading day.

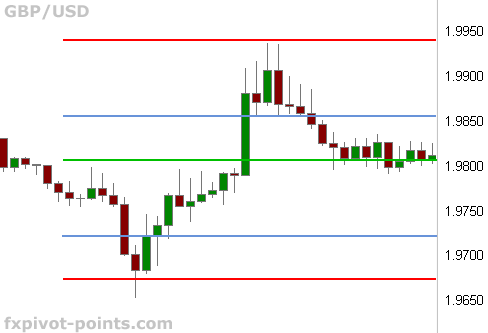

With this Pivot Point as the base, further calculations were used to set support 1, support 2, resistance 1, and resistance 2. These levels would then be used to assist their trading throughout the day. Pivot Points for 1-, 5-, and minute charts use the prior day's high, low and close. In other words, Pivot Points for today's intraday charts would be based solely on yesterday's high, low and close.

Once Pivot Points are set, they do not change and remain in play throughout the day. Pivot Points for 30 and 60 minute charts use the prior week's high, low and close. These calculations are based on calendar weeks. Once the week starts, the Pivot Points for and minute charts remain fixed for the entire week. They do not change until the week ends and new Pivots can be calculated. Pivot Points for daily charts use the prior month's data.

Pivot Points for June 1st would be based on the high, low and close for May. They remain fixed the entire month of June. New Pivot Points would be calculated on the first trading day of July. These would be based on the high, low and close for June. Standard Pivot Points begin with a base Pivot Point. This is a simple average of the high, low and close. The middle Pivot Point is shown as a solid line between the support and resistance pivots. Keep in mind that the high, low and close are all from the prior period.

The chart below shows the Nasdaq ETF QQQ with Standard Pivot points on a minute chart. At the start of trading on June 9th, the Pivot Point is in the middle, the resistance levels are above and the support levels are below. These levels remain constant throughout the day.

Fibonacci Pivot Points start just the same as Standard Pivot Points. From the base Pivot Point, Fibonacci multiples of the high-low differential are added to form resistance levels and subtracted to form support levels. The chart below shows the Dow Industrials SPDR DIA with Fibonacci Pivot Points on a minute chart.

R1 and S1 are based on R2 and S2 are based on Demark Pivot Points start with a different base and use different formulas for support and resistance.

These Pivot Points are conditional on the relationship between the close and the open. The chart below shows the Russell ETF IWM with Demark Pivot Points on a minute chart. Notice that there is only one resistance R1 and one support S1. Demark Pivot Points do not have multiple support or resistance levels. The Pivot Point sets the general tone for price action.

This is the middle line of the group that is marked P. A move above the Pivot Point is positive and shows strength. Keep in mind that this Pivot Point is based on the prior period's data. It is put forth in the current period as the first important level. A move above the Pivot Point suggests strength with a target to the first resistance.

Price Action Trading Course (LEARN FOREX PRICE ACTION)

A break above first resistance shows even more strength with a target to the second resistance level. The converse is true on the downside.

Pivot Point Calculator for daytrading

A move below the Pivot Point suggests weakness with a target to the first support level. A break below the first support level shows even more weakness with a target to the second support level.

Support and resistance levels based on Pivot Points can be used just like traditional support and resistance levels. The key is to watch price action closely when these levels come into play. Should prices decline to support and then firm, traders can look for a successful test and bounce off support.

It often helps to look for a bullish chart pattern or indicator signal to confirm an upturn from support. Similarly, should prices advance to resistance and stall, traders can look for a failure at resistance and decline.

Again, chartists should look for a bearish chart pattern or indicator signal to confirm a downturn from resistance. The second support and resistance levels can also be used to identify potentially overbought and oversold situations.

A move above the second resistance level would show strength, but it would also indicate an overbought situation that could give way to a pullback. Similarly, a move below the second support would show weakness, but would also suggest a short-term oversold condition that could give way to a bounce.

Pivot Points offer chartists a methodology to determine price direction and then set support and resistance levels. It usually starts with a cross of the Pivot Point. Sometimes the market starts above or below the Pivot Point.

Support and resistance come into play after the crossover. While originally designed for floor traders, the concepts behind Pivot Points can be applied across various timeframes. As with all indicators, it is important to confirm Pivot Point signals with other aspects of technical analysis.

A bearish candlestick reversal pattern could confirm a reversal at second resistance.

Oversold RSI could confirm oversold conditions at second support. An upturn in MACD could be used to confirm a successful support test. This is simply because their levels exceed the price scale on the right. In other words, they are off the chart. Standard Pivot Points are the default setting and the parameters box is empty. It is even possible to display all three at the same time. Click here for a live chart with all three Pivot Points. You can then remove the ones you do not want.

This book has a complete chapter devoted to trading with Standard Pivot Points.

How do I calculate forex pivot points?

Person shows chartists how to incorporate Pivot Point support and resistance levels with other aspects of technical analysis to generate buy and sell signals. Market data provided by: Commodity and historical index data provided by: Unless otherwise indicated, all data is delayed by 20 minutes. The information provided by StockCharts. Trading and investing in financial markets involves risk. You are responsible for your own investment decisions. Log In Sign Up Help. Free Charts ChartSchool Blogs Webinars Members.

Table of Contents Pivot Points. Pivot Points for weekly and monthly charts use the prior year's data. A Complete Guide to Technical Trading Tactics John Person. Sign up for our FREE twice-monthly ChartWatchers Newsletter! Blogs Art's Charts ChartWatchers DecisionPoint Don't Ignore This Chart The Canadian Technician The Traders Journal Trading Places. More Resources FAQ Support Center Webinars The StockCharts Store Members Site Map. Terms of Service Privacy Statement.