Forex current interest rates mortgage 30 year fixed

Mortgage rates change daily, although those fluctuations tend to be small; you'll find comfort in knowing when it's a great time to lock in a rate. In the table below, you see the current rates from mortgage providers featured on Investopedia.

Below are the key economic indicators that analysts track in order to try to get a sense of where mortgage rates are heading:. According to econometric models from data provider Trading Economics , general mortgage level rates will stand at around 4.

Stay tuned to important events happening throughout the week that potentially could affect the forecast of interest rates, especially in the short term. Shopping for mortgage rates can be tough.

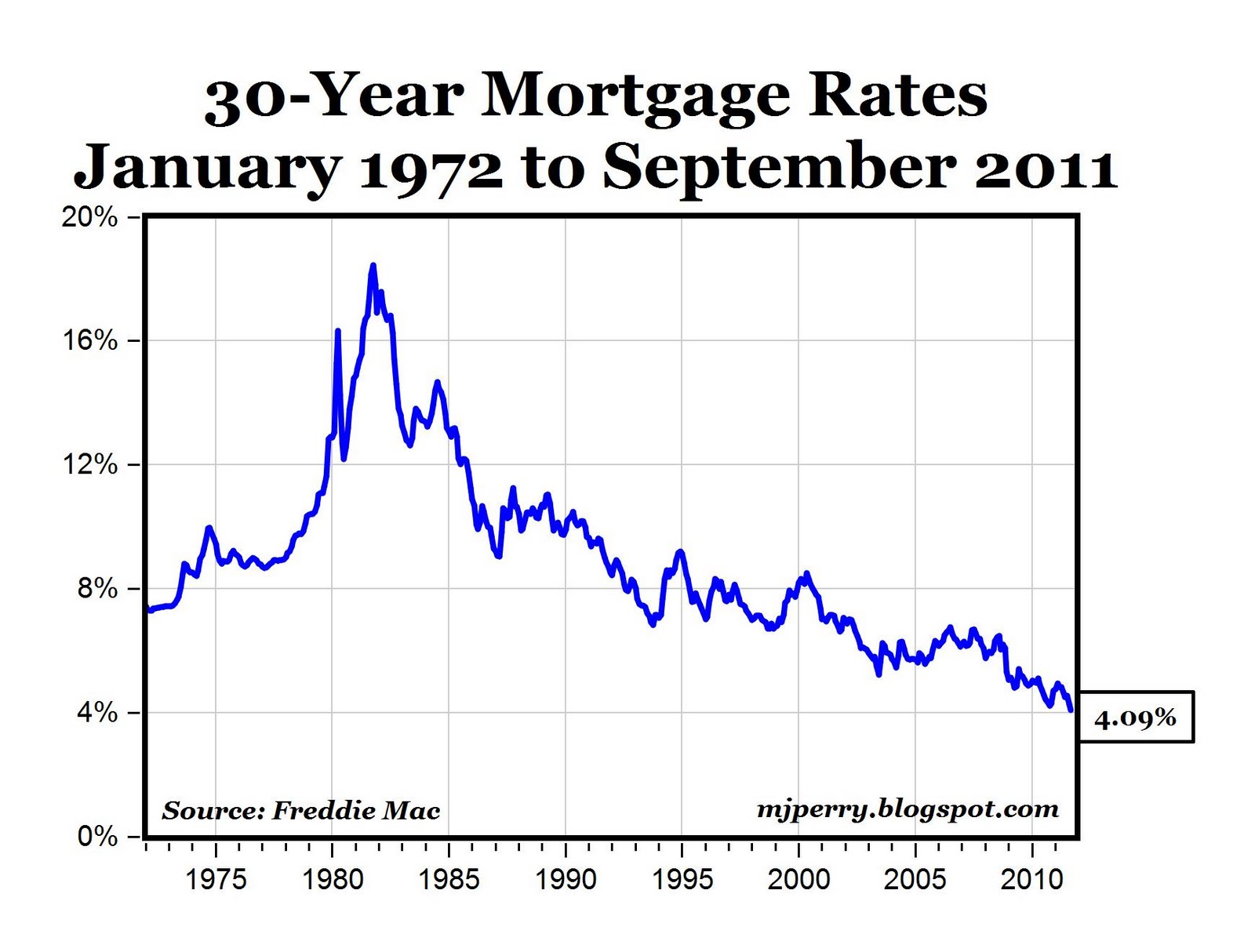

Average 30 Year Fixed Mortgage Rates

Keep in mind the marketplace offers multiple types of mortgages, two of the most popular are fixed-rate and adjusted-rate. Determining which one suits you best will depend on your time horizon, preferences, and goals. Economic forecasts should not be the only information future home-buyers consider. Fixed Or Variable-Rate Mortgage: Which Is Better Right Now?

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Today's Current Mortgage Rates: May 31, By Investopedia Updated May 31, — 2: Mortgage rates are driven by a variety of economic factors, including housing and mortgage market conditions, economic growth, monetary policy, and the bond market.

Mortgage Information : How to Find Low Interest Rates 30 Year Fixed MortgageFor more read The Most Important Factors that Affect Mortgage Rates. Building permits are expected to drop to around 1,, in the next 12 months. For the long term, permits are projected to go up to 1,, by The housing market is sensitive to economic conditions.

A decrease in building permits is generally an early indicator of economic slowdown.

In the case of economic growth, an increase in building permits can signal that the economy is expanding. Global macro models and analysts expectations from Trading Economics show the GDP Growth rate is projected to average around 1. Growth's impact on mortgage rates can be seen via long-term Treasury yields and mortgage-backed securities MBS.

Interest, Mortgages, the Economy. Feds Funds Rate is expected to increase to 1. Mortgage rates are not directly pegged to the Federal Funds Rates, but generally the two rates move in the same direction.

Current Mortgage Rates | 15 & 30 Year Mortgages Interest Rates from BB&T

An increase in the Federal Funds rates is usually followed by an increase in mortgage rates. How The Federal Reserve Affects Mortgage Rates.

Mortgage Rates for 30 year fixed

As home-buying technology has progressed, the process of finding the best mortgages rates for can all be done online. Understand how rate changes can affect home prices and learn how you can keep up.

Understand what drives the federal funds rate and why the Fed would increase that rate.

Zillow

Learn about the effect of a rate increase on the housing market. As home-buying technology has progressed, the process of finding the best mortgages rates can all be done online. Applying for a mortgage can be a strenuous process. Here are five things to avoid doing when meeting with your mortgage broker.

Discover what the most important factors are that affect mortgage interest rates. Factors range from inflation and economic growth to Federal Reserve activity,. Understand the factors that influence the direction of mortgage rates, and use this information to project what will happen with rates in The article looks into the relationship between the economy, interest rates and mortgage rates. Four major players slice and dice your mortgage in the secondary market.

If you are looking to make a purchase or do a refi, you will benefit from continuing low interest rates — that could dip even lower. An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.