Forex options hedging strategies

A forex hedge is a transaction implemented by a forex trader to protect an existing or anticipated position from an unwanted move in exchange rates.

By using a forex hedge properly, a trader who is long a foreign currency pair can be protected from downside riskwhile the trader who is short a foreign currency pair can protect against upside risk. The primary methods of hedging currency trades for the retail forex trader is through spot contracts and foreign currency options.

Forex Hedge & Currency Hedging Strategy - Forex - Investopedia

Spot contracts are the run-of-the-mill trades made by retail forex traders. Because spot contracts have a very short-term delivery date two daysthey are not the most effective currency hedging vehicle.

Introduction to Forex Hedging Strategies - Forex Training Group

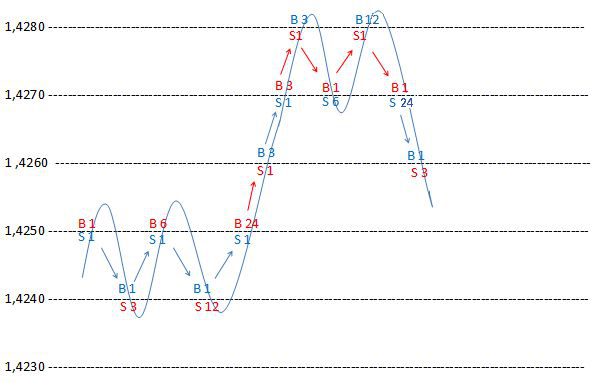

In fact, regular spot contracts are usually the reason why a hedge is needed. Foreign currency options are one of the most popular methods of currency binary options on fibonacci levels. As with options on other types of securities, foreign currency options give the purchaser the right, but not the obligation, to buy or sell the currency forex options hedging strategies at a particular exchange rate how to earn money on steam wallet forex options hedging strategies time in the future.

Regular options strategies can be employed, such as long straddleslong stranglesand bull or bear spreadsto limit the loss potential of a given trade. Not all retail forex brokers allow for hedging within their platforms.

Be sure to research the broker you use before beginning to trade. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Forex Hedging: Creating a Simple Profitable Hedging Strategy

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is a 'Forex Hedge' A forex hedge is a transaction implemented by a forex trader to protect an existing or anticipated position from an unwanted move in exchange rates. Foreign Exchange Market Forex Market Currency Pairs Real Time Forex Trading Currency Futures Forex Broker Historical Currency Exchange Rates.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.