Technical indicators for intraday trading

First to launch Mobile trading application. KEEP THE MARKET AT YOUR FINGER-TIPS. Customized solutions to meet your investment goals. Enjoy efficient, risk-free and prompt depository services. Best-in-class technical insights delivering value.

Be it a beginner or an established trader, following the basic intraday tips is a common practice before starting the trading day. However, your trading strategy changes with time, and the concurrent events play a huge role in its working.

In order to maximize returns, it is essential to understand the market.

Top Technical Indicators For A Scalping Trading Strategy | Investopedia

For this purpose, there are trading indicators. Trading indicators are beneficial tools that are used with a comprehensive strategy to maximize returns.. These are the vital pointers shared by trading indicators.

EasyLiveTrade Best Intraday Technical Analysis Charting Software

These basic, but beneficial pointers help in assessing the market conditions and allow traders to take better decisions with respect to trade positions. Using intraday trading indicators help in averting risk and placing appropriate trades based on technical analysis and market sentiments. Angel Broking Angel Eye offers detailed charts and stock analysis reports that comprise these trading indicators.

These tools help in planning an effective trading strategy, while minimizing risks. Angel Broking Private Limited, Registered Office: G-1, Ackruti Trade Centre, Road No. IN - DP - CDSL - — , PMS Regn. Angel Commodities Broking Private Ltd, Registered Office: Current Offers Knowledge Center About Us Locate Our Branch Contact Us. My Application Form Status Check the status of your application form with Angel Broking.

Angel Broking App Download. Business Partners CRMS Blink Central Bank Trading Login. Locate our Branch --Select State-- Andhra Pradesh Bihar Chhattisgarh Delhi NCR Gujarat Haryana Jharkhand Karnataka Kerala Madhya Pradesh Maharashtra New Delhi Orissa Punjab Rajasthan Tamil Nadu Uttar Pradesh West Bengal --Select City Registered Office G-1, Ackruti Trade Center, Road No-7, MIDC, Andheri E , Mumbai - Demat Account Trading Account Online Share Trading Intraday Trading Share Market Mutual Fund IPO.

The Company Our Values Our Management Milestones CSR Policy. Best Mobile and Online trading platforms to trade. Our Platforms Our Platforms Angel Broking App Angel Broking Trade Angel Speedpro. Download Angel Broking App Now! Start Trading in 1 hour Fill the details below to open your demat account now. Thank you for submitting your details. Choose from our wide range of offerings. Our Products Our Products Equity Currency Trading Commodities Trading Derivatives Life Insurance Mutual Funds.

Our Services Our Services Portfolio Management Offline to online conversion DEMAT Account Investment Advisory Intraday trading. Most awarded stock broking house in India. Fundamental Fundamental Overview Top Picks IPO views Market Outlook. Technical Technical Overview Products Market Watch. Content Content Live News Angel Blog In the Media. Reports Reports Company Reports. Partner with us Partner with us Sub-broker Account Remiser Account Master Franchisee Account.

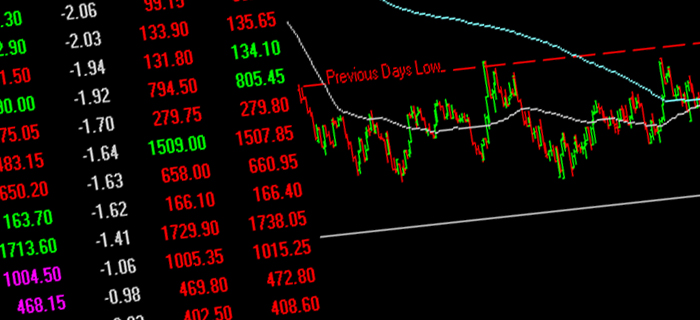

Home Knowledge Center Intraday Trading Intraday Trading Indicators. Information Offered by Intraday Trading Indicators The direction of the trend to determine the movement The lack of or existing momentum within the investment market Profit potential due to the volatility Determine the popularity through volume measurements. Useful Intraday Trading Indicators Moving Averages: Traders often hear about daily moving averages DMA , which is the most common and widely used indicator.

The moving average is a line on the stock chart that connects the average closing rates over a specific period. The longer the period, the more reliable the moving average. This indicator will help you comprehend the underlying movement of the price, as prices do not move only in one direction. Stock prices are volatile and the moving average indicator smoothens the volatility to provide an understanding of the underlying trend of the price movement.

This intraday trading indicator is one step ahead of the moving average. This band comprises three lines—the moving average, an upper limit and a lower one. Stock prices move up and down.

5 Technical Indicators Every Trader Should Know - umisifuy.web.fc2.com

There are short-period cycles that are unrelated to the bullish or bearish market trends. In such cases, it is easy for day traders to miss out on such changes, which is when the momentum oscillator is beneficial.

This indicator is depicted within a range of 0 to , and is advantageous when the price has achieved a new high or low, and one wants to determine whether it will further rise or fall.

In other words, the momentum oscillator helps to understand when the market sentiments are undergoing modifications.

/about/best-technical-indicator-for-day-trading-56a22dc23df78cf77272e6b9.jpg)

Relative Strength Index RSI: This information is then formulated in an index form, which further helps in narrowing down the RSI score ranging between 0 and This index increases with price rises and vice versa. Once the RSI increases or decreases to a specified limit, you can modify your trading strategy. Decoding the Intraday Trading Indicators Moving Averages: If short-term averages are exceeding the long-term averages, it indicates a bullish market trend.

Traders may take a buy call with specific strategies like stop loss either at the long-term moving average or retracement support, and vice versa. This intraday tip can help traders earn decent profits through intraday trading. If the stock is trading at a price below the Bollinger Band lower line, there is potential for the price to increase in the future. Traders can choose to take a buy position.

On the other hand, if the current stock price is over the upper line, traders can sell the share. If the share price has reached a historical high, and the level of the oscillator is not the same as the price, it is indicative of slowly decreasing demand. This also indicates the possibility of a stock price fall.

And the opposite is true for stock price rise. Most analysts will recommend traders to sell the stock when the RSI touches 70 and a buy recommendation when it falls to However, all stocks may not adhere to this pattern, so it is important to analyse the volatility and RSI history before making a decision.

Related Links Intraday Trading Guide for Beginners Tips on How to Pick Stocks for Intraday Trading How to Choose Stocks for Intraday Trading Intraday Trading Time Analysis How to Make Profit in Intraday Trading Intraday Trading: FAQs Angel Blog SMS Service Get Account Statements Feedback Careers Important Documents Miscellaneous Terms of Use.

Products Equity Derivatives Commodities Currency Trading Life Insurance Mutual Funds. Services Portfolio Management DEMAT Account Depository Services Intraday Trading Call Investment Advisory NRI Services. Market Watch Nifty Sensex BSE Top Gainers BSE Top Losers NSE Top Gainers NSE Top Losers. Knowledge Center Demat Account What is Demat Account? Trading Account What is Trading Account?

Benefits of Online Trading Account How to Open a Trading Account Online? How To Trade Online Using Trading Account? Online Share Trading What is Online Share Trading? Online Stock Trading Tips How To Start Your Online Trading Portfolio Online Vs. Intraday Trading Intraday Trading Guide for Beginners What is Intraday Trading How To Make Profit in Intraday Trading Intraday Trading Time Analysis Intraday Trading Indicators Intraday Trading Tips How To Choose Stocks For Intraday Trading?

Share Market Share Market Investment Guide How Does Stock Market Work? Stock Market Guides for Beginners Share Market Basics Share Market Investment Tips and Ideas How To Invest in the Stock Market? How To Trade in the Indian Share Market. The Benefits of Investing in Stocks Investment Opportunities in Stock Market Why Do People Buy Shares? What are Equity Derivatives?

IPO What is an IPO? What is an IPO Process? How Does IPO Work? Mutual Funds How to Buy Mutual Funds? About us The Company Our Values Our Management. Milestones In the Media CSR Policy. Be A Sub-Broker Sub-broker Account Remiser Account Master Franchisee Account.

Contact Us Locate Our Branch. Stocks Stocks Industry Branch City. Mutual Funds Commodities Life Insurance Institutional Equities Angel Fincap.