Binomial tree option pricing in r

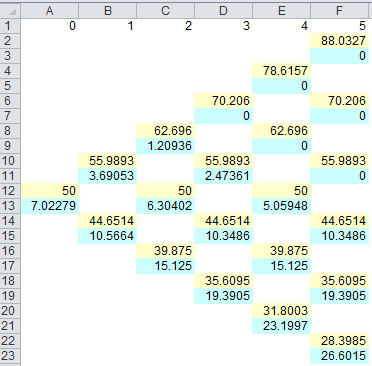

This post by Intel https: My Financial Engineering class was working on Binomial European Option Pricing, and the prof insisted that we show the entire tree matrix for the intermediate steps and not just the final price.

Binomial options pricing model - Wikipedia

Turns out the packages available on https: Either way, good exercise to implement this from scratch and revise for the midterms. Astute readers will recognize this as a Geometric Brownian Motion I will probably make another post about this next time.

We just did what we wanted to do but way faster.

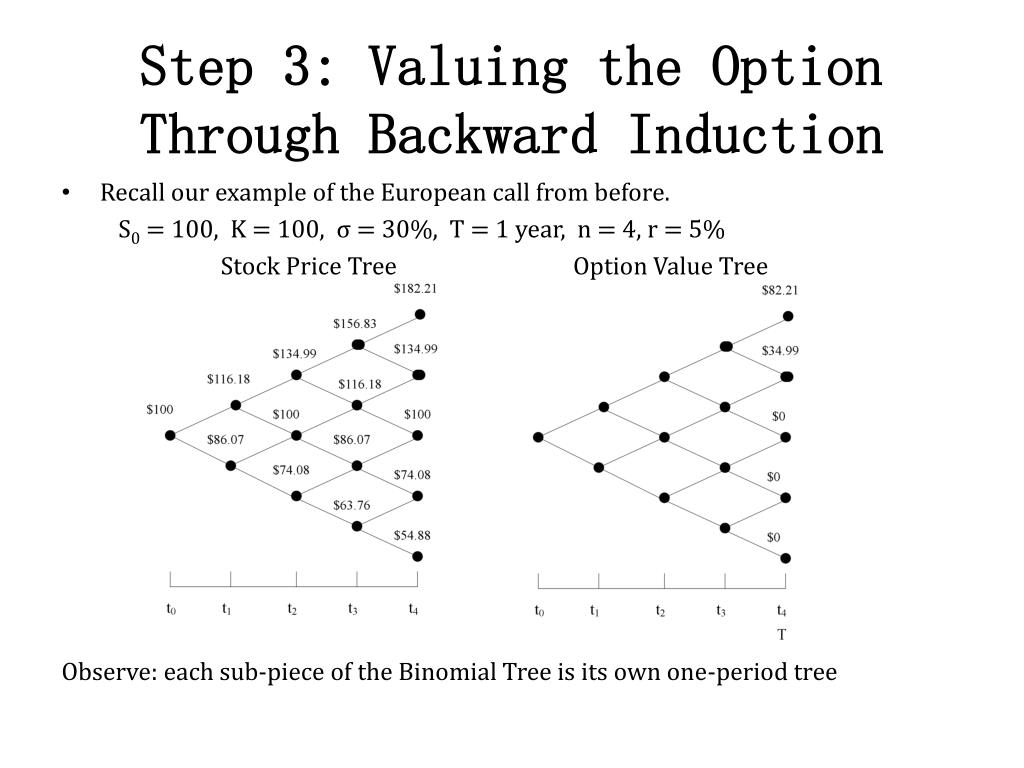

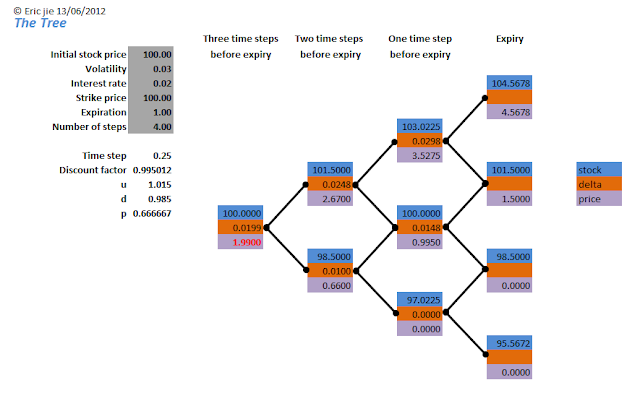

In fact, we can expand the number of levels really easily. But how do we advance up the option back to the price at the beginning? Finance textbooks tell us that.

That means we can derive the step above the last row of the call option. First we find that.

Binomial Option Pricing Model

For the previous option, it would generate. What if we want to find out how option price evolves as we increase the number of periods?

Well we can do that! However, this gets really slow as we increase the number of periods.

Binomial Pricing Trees in R

However, we can use a slightly faster parallel implementation using the library parallel. This assumes that binomial.

R is in the same folder. This should speed things up A LOT. Pandamonium Musings of a Panda.

Then, we can build a stock tree!