Nonstatutory stock option code v

I had a nonstatutory stock option sale reported in box 12 as a V - TurboTax Support

People come to Accountants Community for help and answers—we want to let them know that we're here to listen and share our knowledge. We do that with the style and format of our responses.

The Sorry State of IRS Guidance on Nonqualified Options umisifuy.web.fc2.com

Here are five guidelines:. Saved to your computer.

Select a file to attach: Ask your question to the community. Most questions get a response in about a day. After you register or sign in, we'll return you to this page so you can continue your participation in the community. Back to search results. Asked by chad ProSeries Professional Options Edit Ask for details Archive. Answer 5 people found this helpful Chad, from publication If you receive compensation from employer-provided nonstatutory stock options, it is reported in box 1 of Form W Sale of the stock.

There are no special income rules for the sale of stock acquired through the exercise of a nonstatutory stock option.

Report the sale as explained in the Instructions for Schedule D FormCapital Gains and Losses, for the year of the sale. You may receive a Form B, Proceeds From Broker and Barter Sale Transactions, reporting the sales proceeds. Your basis in the property you acquire under the option is the amount you pay for it plus any amount you included in income upon grant or exercise of the option. Was this answer helpful?

No investment options for nri in india 2015 have been posted. This post has been closed and is not open for comments or answers.

Here are five guidelines: When answering questions, write like you speak. Imagine you're explaining something to a trusted friend, using simple, nonstatutory stock option code v language.

The Sorry State of IRS Guidance on Nonqualified Options umisifuy.web.fc2.com

Avoid jargon and technical terms when possible. When no other word will do, explain technical terms in plain English. Be clear and state the answer right up front. Ask yourself what specific information the person really needs and then nonstatutory stock option code v it. Stick to the topic and avoid unnecessary details.

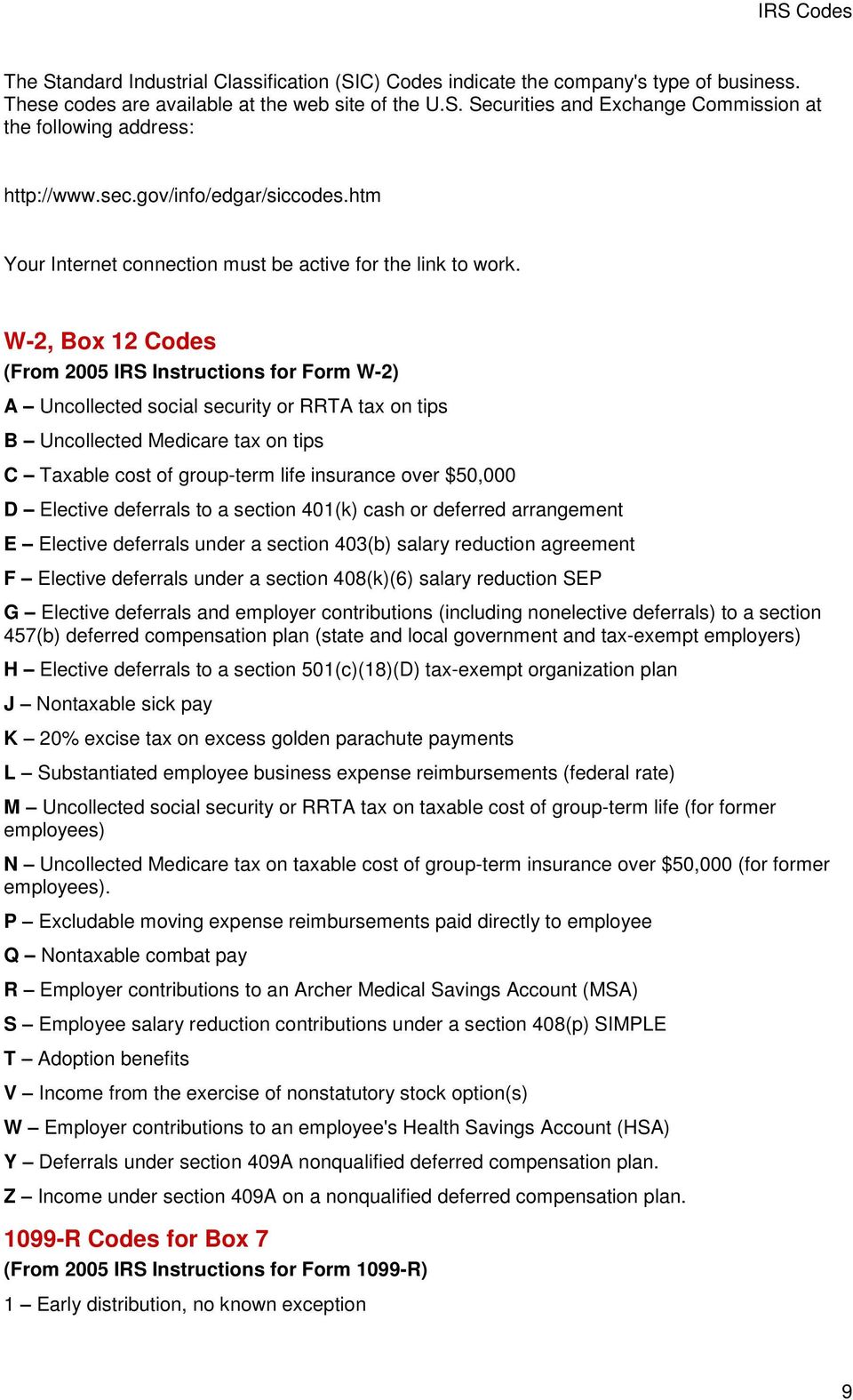

Code V—Income from the exercise of nonstatutory stock option(s). « Specific Instructions for Form W-2

Break information down into a numbered or bulleted list and highlight the most important details in bold. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines. A wall of text can look intimidating and many won't read it, so break it up.

It's okay to link to other resources for more details, but avoid giving answers that contain little more than a link.

Be a good listener. When people post very general questions, take a second to try to understand what they're really looking for. Then, provide a response that guides them to the best possible outcome. Be encouraging and positive.

Look for ways to eliminate uncertainty by anticipating people's concerns. Make it apparent that we really like helping them achieve positive outcomes.

To continue your participation in Accountants Community: Sign in or Create an account.