The day of the week effect on stock market volatility

It is generally a given that there are no free rides or free lunches on Wall Street. With hundreds of investors constantly on the hunt for even a fraction of a percent of extra performance, there should be no easy ways to beat the market.

Nevertheless, certain tradable anomalies seem to persist in the stock market , and those understandably fascinate many investors. While these anomalies are worth exploring, investors should keep this warning in mind — anomalies can appear, disappear and re-appear with almost no warning.

Consequently, mechanically following any sort of trading strategy can be very risky. Small Firms Outperform The first stock market anomaly is that smaller firms that is, smaller capitalization tend to outperform larger companies.

As anomalies go, the small-firm effect makes sense.

A company's economic growth is ultimately the driving force behind its stock's performance, and smaller companies have much longer runways for growth than larger companies. A company like Microsoft NYSE: Accordingly, smaller firms typically are able to grow much faster than larger companies, and the stocks reflect this. January Effect The January effect is a rather well-known anomaly. Here, the idea is that stocks that underperformed in the fourth quarter of the prior year tend to outperform the markets in January.

Explain Like I'm Five: The Volatility of the Stock MarketThe reason for the January effect is so logical that it is almost hard to call it an anomaly. Investors will often look to jettison underperforming stocks late in the year so that they can use their losses to offset capital gains taxes or to take the small deduction that the IRS allows if there is a net capital loss for the year.

As this selling pressure is sometimes independent of the company's actual fundamentals or valuation , this " tax selling " can push these stocks to levels where they become attractive to buyers in January.

Likewise, investors will often avoid buying underperforming stocks in the fourth quarter and wait until January to avoid getting caught up in this tax-loss selling.

As a result, there is excess selling pressure before January and excess buying pressure after Jan. Low Book Value Extensive academic research has shown that stocks with below-average price-to-book ratios tend to outperform the market. Although this anomaly makes sense to a point unusually cheap stocks should attract buyers' attention and revert to the mean , this is unfortunately a relatively weak anomaly. Though it is true that low price-to-book stocks outperform as a group, individual performance is idiosyncratic, and it takes very large portfolios of low price-to-book stocks to see the benefits.

7 Market Anomalies Investors Should Know

Neglected Stocks A close cousin of the "small-firm anomaly," so-called neglected stocks are also thought to outperform the broad market averages. The neglected-firm effect occurs on stocks that are less liquid lower trading volume and tend to have minimal analyst support. The idea here is that as these companies are "discovered" by investors, the stocks will outperform. Research suggests that this anomaly actually is not true — once the effects of the difference in market capitalization are removed, there is no real outperformance.

Consequently, companies that are neglected and small tend to outperform because they are small , but larger neglected stocks do not appear to perform any better than would otherwise be expected. With that said, there is one slight benefit to this anomaly — though the performance appears to be correlated with size, neglected stocks do appear to have lower volatility. Reversals Some evidence suggests that stocks at either end of the performance spectrum, over periods of time generally a year , do tend to reverse course in the following period — yesterday's top performers become tomorrow's underperformers, and vice versa.

Not only does statistical evidence back this up, the anomaly makes sense according to investment fundamentals. If a stock is a top performer in the market, odds are that its performance has made it expensive; likewise, the reverse is true for underperformers. It would seem like common sense, then, to expect that the over-priced stocks then underperform bringing their valuation back more in line while the under-priced stocks outperform.

Reversals also likely work in part because people expect them to work. If enough investors habitually sell last year's winners and buy last year's losers, that will help move the stocks in exactly the expected directions, making it something of a self-fulfilling anomaly.

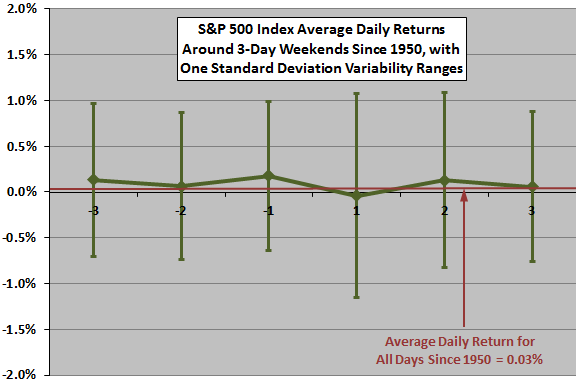

Days of the Week Efficient market supporters hate the Days of the Week anomaly because it not only appears to be true; it makes no sense. Research has shown that stocks tend to move more on Fridays than Mondays, and that there is a bias toward positive market performance on Fridays. It is not a huge discrepancy, but it is a persistent one. On a fundamental level, there is no particular reason that this should be true.

Some psychological factors could be at work here, though. Perhaps an end-of-week optimism permeates the market as traders and investors look forward to the weekend.

Alternatively, perhaps the weekend gives investors a chance to catch up on their reading, stew and fret about the market, and develop pessimism going into Monday. Dogs of the Dow The Dogs of the Dow is included as an example of the dangers of trading anomalies. The idea behind this theory was basically that investors could beat the market by selecting stocks in the Dow Jones Industrial Average that had certain value attributes.

Investors practiced different versions of the approach, but the two most common were: It is unclear whether there was ever any basis in fact for this approach, as some have suggested that it was a product of data mining.

SpringerLink unavailable | SpringerLink

Even if it had once worked, the effect would have been arbitraged away - say, for instance, by those picking a day or week ahead of the first of the year.

Moreover, to some extent this is simply a modified version of the reversal anomaly; the Dow stocks with the highest yields probably were relative underperformers and would be expected to outperform. The Bottom Line Attempting to trade anomalies is a risky way to invest.

Not only are many anomalies not even real in the first place, they are unpredictable. What's more, they are often a product of large-scale data analysis that looks at portfolios consisting of hundreds of stocks that deliver just a fractional performance advantage.

Since these analyses often exclude real-world effects like commissions, taxes and bid-ask spreads , the supposed benefits often disappear in the hands of real-world individual investors. With that said, anomalies can still be useful to an extent. It seems unwise to actively trade against the Day of the Week effect, for instance, and investors are probably better off trying to do more selling on Friday and more buying on Monday.

SpringerLink unavailable | SpringerLink

Likewise, it would seem to make sense to try to sell losing investments before tax-loss selling really picks up and to hold off buying underperformers until at least well into December. All in all, though, it is probably no coincidence that many of the anomalies that seem to work hearken back to basic principles of investing. Small companies do better because they grow faster, and undervalued companies tend to outperform because investors scour the markets for them and push the stocks back up to more reasonable levels.

Ultimately, then, there is nothing really anomalous about that at all — the notion of buying good companies at below-market valuations is a tried-and-true investment philosophy that has held up for generations. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Seven Market Anomalies Investors Should Know By Stephen D. Certain tradable anomalies persist in the stock market.

Here are six that fascinate investors. Stocks sometimes thwart the efficient market theory by showing some very unusual patterns. Learn about what is being dubbed the low-volatility anomaly, why it exists and what we can learn from it.

Investors need to be aware that time moves on and often leaves trendy investing techniques in the dustbin. Make your trading safer and more streamlined by following these simple guidelines.

What about best month? Here's how time affects trading decisions based on daily, weekly and monthly trends. Investopedia explores the working of behavioral funds, their benefits and risks, and an analysis of their past returns.

Make sure you buy in low to ride this phenomenon for all it's worth. An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.