Danger of buying stock on margin

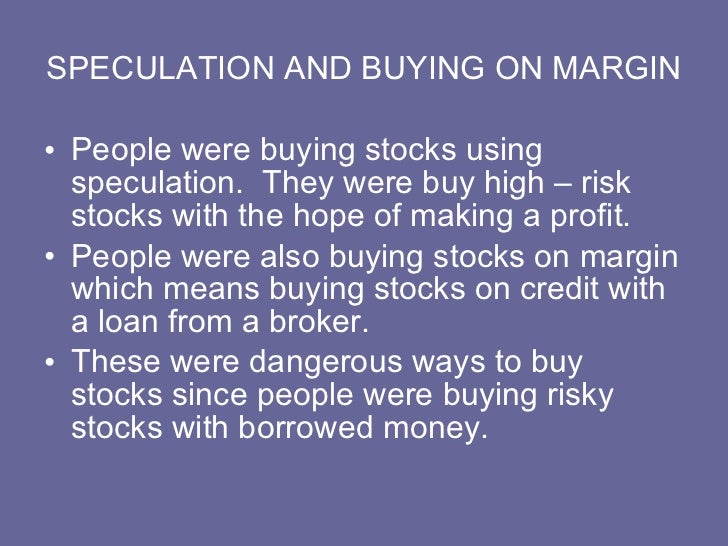

One way to purchase stocks is to buy them on margin. Also referred to as leveraging, buying stocks on margin can result in a large return when the stock goes up. Buying on margin allows you to purchase more stocks by using the assets you already have as collateral for the loan, and it also lets you to react quickly to new investment opportunities because you have the added money in your account.

What Is the Danger of Buying Stocks on Margin? Buying stocks on margin can be a risky venture and result in financial straits if you're not careful.

In fact, buying stocks on margin is actually the only way in the stock market that an investor can lose more than he actually put in Some of the dangers of buying stocks on margin include: It's not for the novice. On the surface and if done properly, buying on margin can almost double your buying power. However, it requires a great deal of knowledge as little rules and fees can add up, leaving the investor in the hole.

In addition, your margin account must stay within a certain percentage, and if it drops below that you only have a few days to replenish the account. Not all stocks are marginable, and purchasing stocks on margin can get you into trouble if you're not careful or if you don't know what you're doing. You could end up owing more than your initial investment.

If the stock goes up and you make a profit, great. A margin call mean the investor much put more money into the account. If he can't do this, however, he'll have to sell the stock, pay the broker the amount owed, which might even be more once commissions are figured in.

It requires a good deal of knowledge about marginable stocks. If this is the case, the investor will get a Fed call from his broker, telling him he has three days to put enough money to cover it into his account.

Buying on margin is similar to using a credit card. Often, when buying things on credit, people spend recklessly because they forget, either subconsciously or not, that they eventually have to pay that back, with interest.

Buying on margin is similar. If you don't make money, you'll have to pay it back, plus taxes and brokerage commissions.

Buying on margin comes with a number of risks, and it's best to carefully research each one and discuss with your broker whether buying on margin is right for you. What Is the Danger of Buying on Margin? Margin Trading , Share this article: Socializer , Digg , del. Add to favorites Tags: Different Types of Real Estate Investments Different Types of Investment Risks Choosing A Life Insurance Policy Is Important For Some People Best Investment Strategies to Follow Adding Bonds To Your Investment Portfolio Why liquidity matters Why a Roth IRA is the best way to save for Retirement What To Know When Making a Good Investment Using Real Estate Investing When Retired Should I Dip Into My K For A Down Payment?

What was one major danger of buying stock on margin

Subscribe to our free newsletter and get our "How To Get More Leads" course free via email. Just enter your first name and email address below to subscribe.

Business Info Marketing and Sales Technology Finance Manufacturing Small Business Investing Employee Health and Fitness Sponsored Links. Managing Your Investments With A Good Advisor Can Make Sense It Is Easy To Learn How To Convert To Roth Accounts Investing In The Diet Industry How To Choose A Good Fund Manager How To Choose A Good Fund Manager How To Choose A Good Fund Manager How To Choose A Good Fund Manager How to Avoid Bad Investments Does it Pay to Hire A Financial Advisor?

Margin Trading: The Risks

Different Ways To Diversify Your Portfolio Protects From Financial Ruin. Syndicate this information XML , Atom , RDF. Search This Site import url http: